- The proposal empowers AAVE token holders with control over brand assets.

- It sets significant decentralization by moving control to DAO governance.

- Expect increased AAVE token value and robust anti-capture measures.

On December 17, Aave core contributor Ernesto Boado proposed transferring control of Aave’s brand assets to AAVE token holders, creating a DAO-controlled governance structure.

The proposal highlights a significant shift in Aave’s governance, offering token holders potential influence over brand assets, potentially impacting AAVE’s long-term value and investor interest.

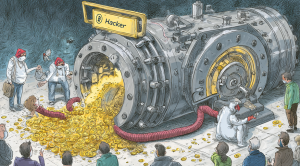

Aave’s Brand Assets Shift to DAO Governance Model

Ernesto Boado’s proposal titled “[ARFC] AAVE token alignment. Phase 1 – Ownership” was released on Aave’s governance forum. It suggests granting AAVE token holders control over Aave’s brand assets through a DAO-controlled entity with strong anti-capture protections. As Boado explains, “This is an Aave Governance proposal for AAVE token holders to request receiving control of Aave’s brand assets (domains, social handles, naming rights, etc), on a DAO-controlled vehicle (defined at a later stage) with strong anti-capture protections”.

The proposal’s main change is the shift of brand asset control from current holders to DAO governance, marking a significant direction toward decentralization. This may enhance the perceived value of AAVE tokens as it underscores true ownership.

Community and expert reactions include Aave Chan Initiative founder Marc Zeller, who stated it represents a pivotal moment in Aave’s governance. Tulip King, former Messari analyst, views this as a critical governance step, emphasizing the need for DAOs to exert control.

Market Trends and Expert Opinions on AAVE Token Dynamics

Did you know? The shift to DAO governance could redefine ownership models in decentralized finance.

As of December 17, 2025, Aave (AAVE) trades at $185.41 with a market cap of $2.84 billion and a 24-hour trading volume of $305.51 million, down 30.73%. Over a 90-day period, AAVE has seen a significant decrease of 39.76%. Data are sourced from CoinMarketCap.

Expert analysis suggests that DAO control over brand assets could lead to more secure governance frameworks in DeFi. This shift might offer enhanced utility and engagement for stakeholders, potentially increasing market trust and adoption.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |