- MiniMax’s Hong Kong IPO supported by Alibaba and ADIA.

- Raising over $600 million in funding.

- No direct cryptocurrency market impact linked.

MiniMax, a leading Chinese AI startup, is set to launch a Hong Kong IPO in January, aiming to raise over $600 million with backing from Alibaba and ADIA.

This IPO highlights increasing investment in artificial intelligence, though it has no direct impact on cryptocurrency markets as it concerns traditional equity and AI advancements.

Alibaba and ADIA’s $600M Investment in MiniMax IPO

MiniMax, formally known as Shanghai Xiyu Technology Co., Ltd., has announced its intention to list in Hong Kong, aiming to raise over $600 million. Alibaba Group Holding Limited and the Abu Dhabi Investment Authority are reported as major backers for this listing. MiniMax, a noted leader in China’s AI sector, will reportedly begin investor subscription shortly. This move highlights global interest in China’s AI development, showcasing support from significant international investors like Alibaba and ADIA.

Alibaba has acquired approximately a 13.66% stake, purportedly to integrate AI models into its cloud services. This investment is part of a larger trend where global players look to leverage Chinese AI innovations. The IPO will position MiniMax alongside China’s leading AI companies, focusing on multimodal models with broader AGI ambitions. Immediate implications include potential advancements in AI tech offerings from MiniMax, intensifying competition within the Chinese AI market.

Based on the information you’ve provided, there seem to be no direct quotes or statements from key figures related to the MiniMax IPO in Hong Kong as of December 30, 2025. The news primarily stems from secondary sources like Bloomberg and does not include verifiable statements from leadership, industry experts, or relevant KOLs.

Market reactions have been muted in cryptocurrency spheres, as the IPO centers on traditional equity markets. Official regulatory bodies in Hong Kong have been reported to scrutinize the offering, suggesting a careful watch from international investors. No direct comments were found from crypto market influencers or related government officials.

Chinese AI Sectors Influence Amid MiniMax’s Public Debut

Did you know? The Hong Kong Stock Exchange has seen an increase in IPO interest, with AI-related sectors gaining traction due to advancements in technology and global enterprise backing.

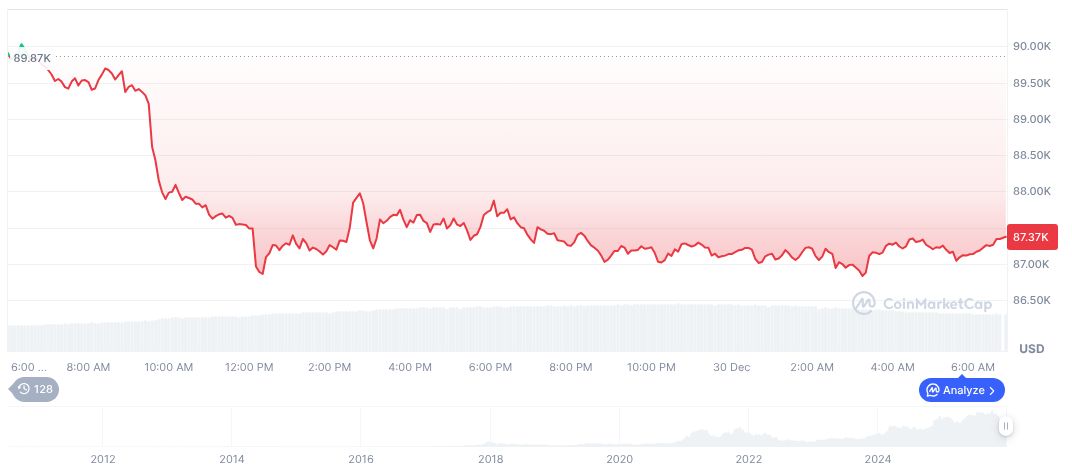

According to CoinMarketCap, Bitcoin (BTC) trades at $88,305.33 with a market cap of $1.76 trillion. Bitcoin, holding a 59.09% market dominance, showed a slight 1.42% 24-hour increase despite a 26.54% drop in trading volume. In the past 90 days, BTC’s value declined by 25.12%, indicating recent volatility.

Coincu research team estimates that MiniMax’s foray into the public domain could catalyze further investments in AI-oriented startups. Analysts predict increased regulatory interest due to large funding moves and high-profile backing by renowned international entities like Alibaba. This IPO might set a benchmark for upcoming Chinese AI listings.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |