- Bank of America permits 1-4% Bitcoin ETF allocations.

- Part of broader digital asset adoption.

- Pioneers institutional integration of Bitcoin.

Bank of America now permits its wealth advisors to recommend Bitcoin allocations up to 4% through ETFs, beginning January 2026.

This regulatory shift highlights increasing institutional acceptance of digital assets, potentially impacting Bitcoin’s market dynamics and broader adoption within traditional finance systems.

Bank of America Embraces Bitcoin with ETF Allocations

Bank of America has granted wealth advisors the ability to recommend Bitcoin ETF allocations between 1-4%, signifying a significant shift towards embracing digital assets in mainstream financial services. This initiative, effective from January 5, 2026, is expected to pave the way for broader acceptance and integration of cryptocurrencies into traditional investment strategies.

The immediate changes involve incorporating Bitcoin ETFs into client portfolios, allowing for diversified investment approaches that include digital asset exposure. By aligning with this trend, Bank of America joins a growing number of financial institutions adapting to digital currencies.

Andrew W. Lee, Chief Investment Officer, Bank of America, said, “Starting January 2026, we are enabling our wealth advisors to recommend a strategic allocation of Bitcoin ETFs, recognizing the growing institutional interest in digital assets.”

Market reactions to this development have been cautiously optimistic, with financial analysts highlighting the potential for increased Bitcoin legitimacy within institutional frameworks. However, key figures in the crypto community have yet to comment officially on this strategic move by Bank of America.

Market Data and Insights

Did you know? Bitcoin was created in 2009, and it was the first decentralized cryptocurrency, paving the way for thousands of alternative cryptocurrencies.

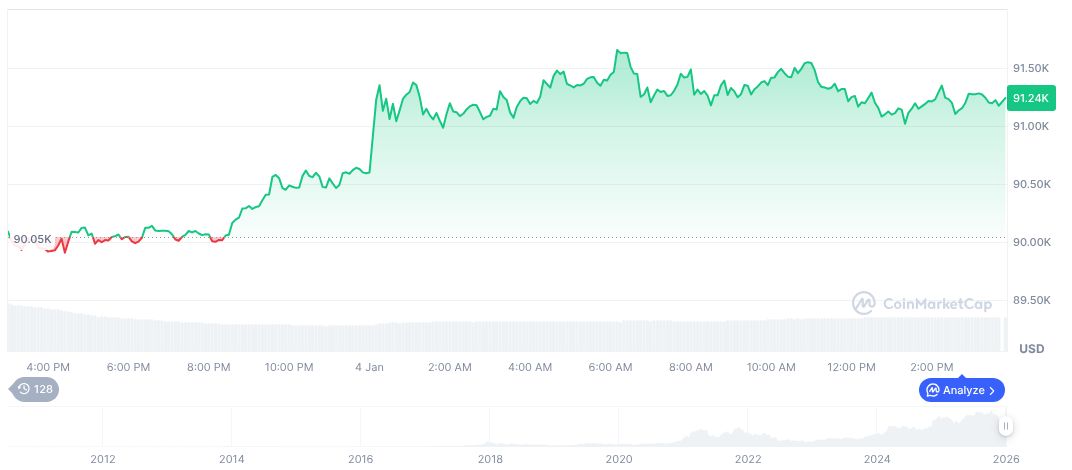

As of January 5, 2026, Bitcoin (BTC) is trading at $92,424.37, holding a market cap of $1.85 trillion and maintaining a dominant market presence at 58.66%. The fully diluted market cap stands at $1.94 trillion. CoinMarketCap data reflects that BTC’s trading volume surged to $33.62 billion over the past 24 hours.

Insights from Coincu’s research team suggest a probable increase in Bitcoin’s financial integration in institutional portfolios. There may also be heightened regulatory focus on Bitcoin ETFs as regulatory bodies enhance guidelines around digital assets, impacting future market dynamics. For more insights on these trends, refer to the 2026 Crypto Market Outlook by SVB.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |