- Binance launches perpetual contracts for ZKP, GUA, IR with high leverage.

- December 21, 2025, marks the launch date for these contracts.

- USDS-margined, offering risk-managed trading opportunities.

Binance Futures launched USDS-Margined ZKPUSDT, GUAUSDT, and IRUSDT perpetual contracts on December 21, 2025, offering leverage up to 40 times, at 10:00 UTC.

These launches may influence trading strategies and liquidity for the associated tokens, as traders potentially capitalize on flexible leverage options in a volatile market environment.

Binance Diversifies with High-Leverage Perpetual Contracts

Binance Futures launched ZKP, GUA, and IR perpetual contracts, expanding their offerings on December 21, 2025. These contracts are part of Binance’s ongoing effort to diversify trading options. The introduction broadens accessibility for traders seeking varied crypto-derivatives with significant leverage.

Market implications include increased trader participation due to leverage opportunities—up to 40x for ZKPUSDT and 20x for GUAUSDT and IRUSDT. The inclusion of these contracts is expected to influence trading strategies and liquidity levels, positioning traders for higher risks and potential returns.

Changpeng Zhao, CEO of Binance, stated, “Our new perpetual contracts provide traders with more flexibility and control over their investments, a step towards our goal of facilitating financial freedom globally.”

Industry reactions remain muted, with no significant statements from market leaders. The introduction, however, aligns with Binance’s aggressive strategy in the derivatives space. Binance’s promotion may stimulate nuanced shifts in trading volumes, though official responses are yet unvoiced.

Analyzing Binance’s Market Strategy Amidst Crypto Volatility

Did you know? Binance’s past introduction of the BOBUSDT perpetual with a 20x leverage a month prior indicates a strategic pattern in its product offerings.

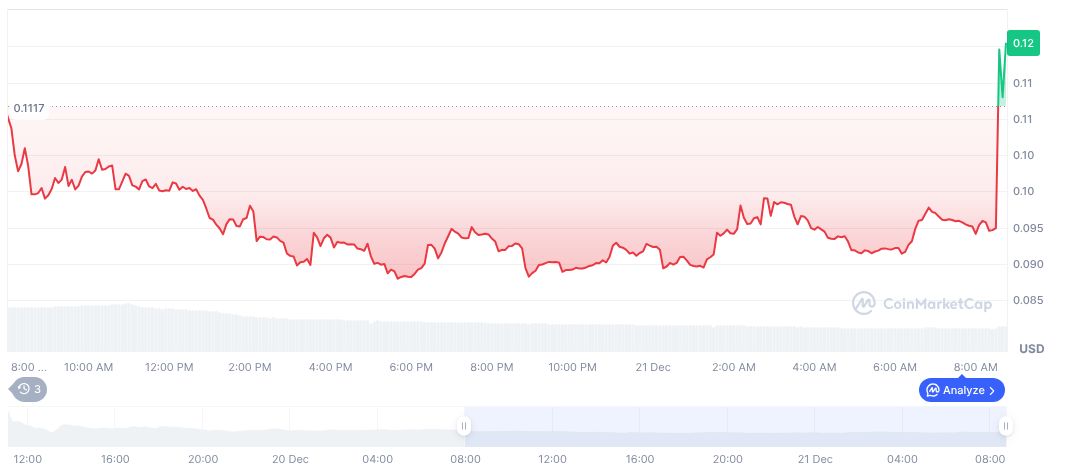

According to CoinMarketCap, zkPass (ZKP) shows volatility, trading at $0.11 with a market cap of $22.68 million. Recent data highlights a 12.84% increase over 24 hours, although it is down 52.88% over longer-term periods, reflecting potential instability in its recent history.

Coincu analysts suggest Binance’s maneuver positions them amidst market fluctuations by capitalizing on emerging crypto derivatives. Examining prior trading trends offers insights into this strategic move, anticipating regulatory impacts and technological advancements that could reshape trading conditions. For instance, recent events highlight the diversification benefits for traders during unexpected market movements.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |