• Morgan Stanley Opens Direct Bitcoin Trading on E-TRADE for Everyday Retail Investors

• Bitcoin holds as $85k–$90k gamma caps moves

• Binance faces US court as judge rejects pre-2019 arbitration

• Tether draws $350–$375B valuation on secondary trades

• Bybit Unveils 2025 Security Milestone: Intercepts $300M in Impersonalization, Scams and Frauds via New AI-Driven Risk Framework

• Japan’s SBI and Startale Launch First Bank, Backed Yen Stablecoin

• Crypto payments face review as UKGC studies betting use

• Tokenized Gold draws bids as crypto sells off; macro focus

• Figure Technology Solutions posts 574% FY25 income jump

• Hyperliquid HIP-6 Proposal Set to Revolutionize Token Launches

Binance Withdrawal Wave Has Ended After $4.3 Billion Settlement

2 mins mins

Key Points:

-

The Binance withdrawal wave sees stability in fund outflows after over $1 billion was lost after founder Changpeng Zhao’s departure and legal challenges.

-

The fallout from the Binance settlement’s $4.3 billion with the US government and CZ’s resignation extends globally.

-

Binance’s efforts to establish a cryptocurrency exchange in Thailand and its promotional activities in the Philippines face legal roadblocks as regulatory scrutiny intensifies.

In the aftermath of Binance’s recent challenges, data monitored by Nansen reveals a shift in fund dynamics. Following a significant Binance withdrawal wave prompted by the departure of founder Changpeng Zhao (CZ) and legal issues, the outflow from the exchange has stabilized.

Binance Withdrawal Wave Has Stabilized Amidst Shifting Tides

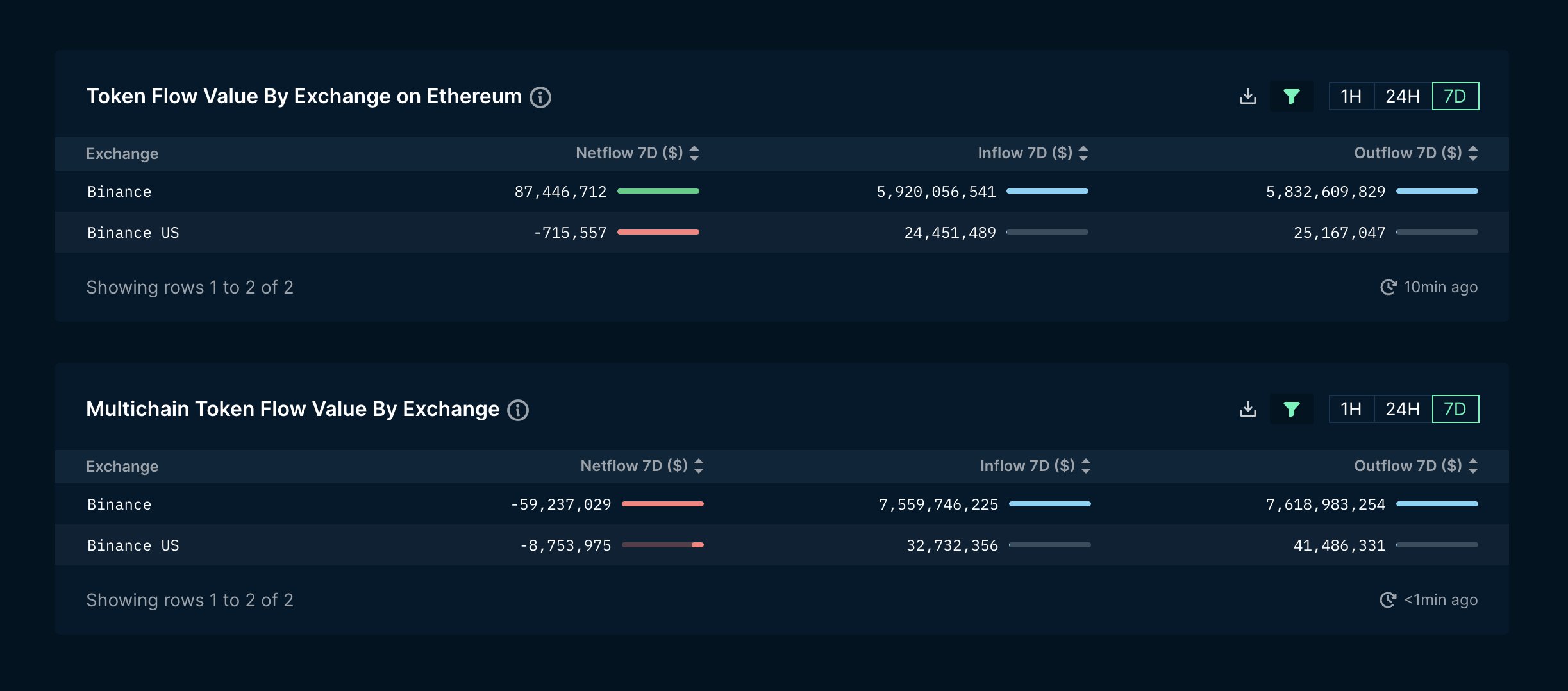

According to Nansen, over the past 7 days, the Ethereum chain experienced a notable $86.7 million net inflow, contrasting with multi-chain tokens witnessing a $68 million net outflow. Despite fluctuations, current exchange holdings, as of the latest data, stand at $65.1 billion, reflecting a marginal dip from the pre-announcement figure of $65.8 billion.

CZ’s resignation led to a remarkable event where the Binance withdrawal wave reached over $1 billion in a 24-hour span, excluding Bitcoin. This incident mirrors a historical pattern observed when the exchange and its founder faced 13 securities violations from the SEC, resulting in a $4.3 billion settlement with the US government.

The consequences of the $4.3 billion deal and CZ’s resignation extend beyond the United States, impacting Binance’s attempts to establish a cryptocurrency exchange in Thailand. Partnering with Gulf Energy, owned by Thai billionaire Sarath Ratanavadi, the venture faces potential legal hurdles.

Meanwhile, in the Philippines, the Securities and Exchange Commission (SEC) has raised concerns about Binance’s promotional activities on social media. In response, the Philippine SEC is gearing up to take action, considering blocking access to Binance to secure the public from unregistered investment products.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.