- Crypto.com, Deribit accept BlackRock’s tokenized fund as trading collateral.

- Enhances institutional access to blockchain-based U.S. Treasuries.

- Potential impact on crypto liquidity, stablecoin usage in trading.

Crypto exchanges Crypto.com and Deribit have begun accepting BlackRock’s tokenized fund BUIDL as collateral as of June 18, 2025, enhancing institutional client engagement across spot, margin, and OTC trading platforms.

The introduction of BlackRock’s tokenized U.S. Treasury fund into crypto markets is notable for its potential to increase liquidity and offer a new collateral source, potentially reducing reliance on traditional stablecoins.

BlackRock’s BUIDL: A Game-Changer in Crypto Collateral

BlackRock’s move to issue BUIDL, the first tokenized U.S. Treasury fund, has been supported by Securitize as tokenization partner and accepted by exchanges Crypto.com and Deribit. This acceptance allows the BUIDL to be used widely in crypto trading, increasing accessibility and integration of traditional financial instruments into the crypto landscape.

Institutional clients, with a minimum allocation of $5 million, now have a new collateral option that yields an annual return of 4.5%. This enables traditional finance participants to diversify their trading strategies and engage with crypto markets more actively.

BUIDL becomes the first tokenized U.S. Treasury fund to be accepted as collateral across multiple leading exchanges. — BlackRock Press Release, BlackRock

Market observers noted that while no major industry figures commented publicly, the introduction of tokenized U.S. Treasuries as collateral is expected to enhance market liquidity and diversify risk. Experts predict a positive reception from financial institutions looking for yield-generating assets.

Expert Insights and Future Implications for Crypto Markets

Did you know? USDT and USDC have traditionally dominated as collateral assets in crypto trading. The acceptance of BUIDL might shift the balance, reflecting the increasing intersection of conventional finance and blockchain.

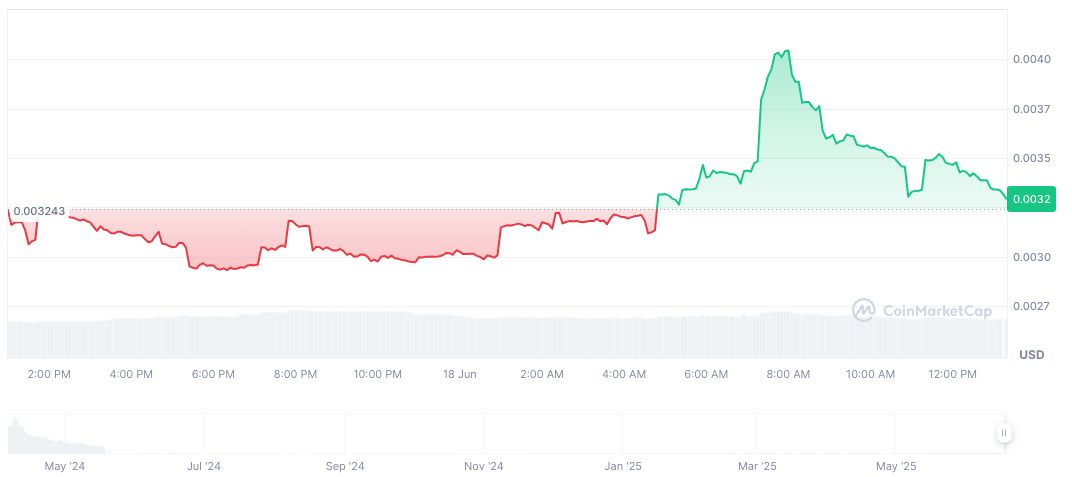

CoinMarketCap reports that despite its prominence, Starter.xyz (BUIDL) currently holds a price of $0.00 with a market cap at $0. Recent price movements indicate a 4.99% increase over the past 24 hours. As the BUIDL is still developing, trading volume reached $2,492,907.20.

Coincu’s research team states that tokenized Treasuries could act as a catalyst, bringing fresh capital into decentralized ecosystems and fueling technological innovations. Market watchers anticipate this could drive transformative changes in both crypto trading strategies and regulatory landscapes worldwide.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |