- Interest on digital RMB: Six banks initiate interest payments.

- Digital RMB wallets earn 0.05% in 2026.

- Includes real-name Category I-III wallets.

Six major Chinese banks announced that starting January 1, 2026, digital RMB real-name wallets will earn interest at current deposit rates of 0.05%.

This policy aligns China’s digital currency with traditional banking practices, potentially enhancing the digital yuan’s adoption while integrating within the existing financial system.

Six State Banks to Offer Digital RMB Interest

Six state-owned banks in China, including the Bank of China and ICBC, have announced that digital RMB real-name wallets will start earning interest from January 1, 2026. Interest payments will be made at the banks’ current deposit rate of 0.05%.

The interest calculation and settlement rules will align with current deposit rates, potentially increasing the appeal of the digital RMB. Only real-name wallets (Categories I-III) qualify for interest, excluding anonymous Category IV wallets, thus emphasizing the push for transparency.

While the People’s Bank of China (PBOC) has not publicly commented, its stance supports this move as part of integrating digital currency into mainstream finance. Market watchers view this as a natural step in China’s digital currency strategy.

Digital RMB Integration and Global Impact

Did you know? China’s digital RMB processed 3.48 billion transactions by November 2025, totaling 16.7 trillion yuan ($2.38 trillion), illustrating its strong adoption rate amid ongoing PBOC initiatives.

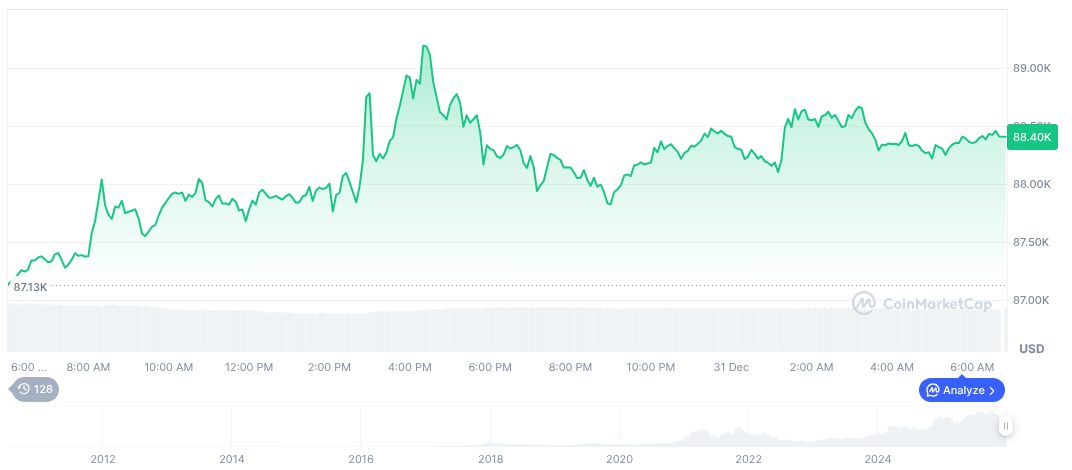

According to CoinMarketCap, Bitcoin (BTC) currently trades at $88,719.42, holding a market cap of $1.77 trillion and constituting 59.11% market dominance. Its circulating supply stands at 19,969,543 BTC, closing in on its max supply of 21,000,000.

Experts from the Coincu research team anticipate strengthening digital currency integration with traditional banking through digital RMB innovations. Such integrations could bolster the digital currency ecosystem, aligning with China’s broader fintech goals. Expectations include enhanced regulatory frameworks to manage this evolution.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |