- China considers pilot stablecoin regulation in free trade zones.

- Proposal aims to leverage zones like Qianhai, Shenzhen.

- Global stablecoin regulation spurs strategic local discussions.

Zhao Zhongxiu and experts propose piloting global stablecoin regulation in China’s free trade zones, including Qianhai and Hainan, amidst worldwide legalization efforts.

Crucial for China’s digital currency strategy, pilot programs may enhance blockchain infrastructure, stabilize financial environments, and attract legitimate stablecoin issuers.

China Proposes Stablecoin Pilot Programs in Free Trade Zones

China’s proposal involves opening pilot programs in Qianhai Free Trade Zone, Shenzhen, and Hainan Free Trade Port. These pilots aim to develop financial technology labs and create an offshore RMB stablecoin pilot. The move coincides with global adoption of stablecoin regulations, potentially influencing broader regional policies.

These pilot programs could lead to an increase in digital trade and the strengthening of blockchain infrastructure. Important elements include transparent audits and strict compliance protocols. The plan involves coordination across various governmental and economic sectors to ensure a controlled environment for stablecoin operations.

The financial and crypto communities have observed this move, with some stakeholders showing cautious optimism about China’s prospective embrace of stablecoins. Eddie Yue, Chief Executive of the Hong Kong Monetary Authority, stated, “Only a few stablecoin licenses will be issued in the first phase with high compliance standards.” Regulatory entities, like the Hong Kong Monetary Authority, continue to set stringent compliance standards for local and global activities.

Insights on Stablecoin Impact and Regulatory Prospects

Did you know? In 2024, Hong Kong initiated stablecoin legislation focusing on compliance over rapid issuance, whereas China traditionally restricted stablecoins to curb risks associated with capital flight.

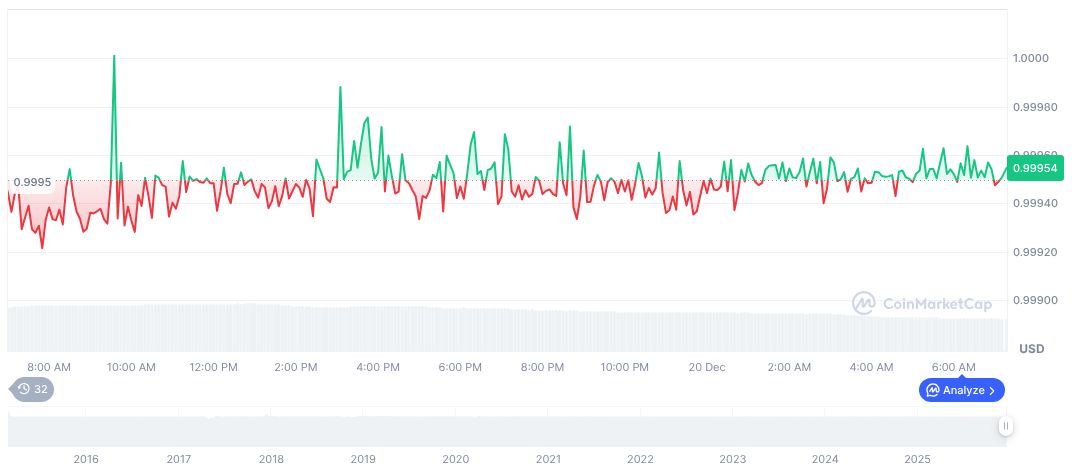

Tether (USDT) remains stable at $1.00 with a significant market cap of $186.76 billion, as reported by CoinMarketCap. Its trading volume, despite a drop of 47.02%, signifies a vital role in the market. Recent movements indicate minimal fluctuation over the past 90 days.

Insights from the Coincu research team suggest that China’s pilot programs could test the regulatory waters and explore stablecoin integration within its economic system. “Stablecoins act as the major bridge that facilitates direct interconnection between the traditional financial system and the virtual asset world,” said Geoffrey Chan, Head of Skadden’s Asia Investment Management Group. These initiatives may lead to enhanced digital finance opportunities while adhering to stringent compliance standards, thereby exerting influence on future regulatory frameworks.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |