Circle Executes Routine USDC Treasury Burn Worth $135.6 Million

- USDC Treasury destroys 135.6 million USDC as part of regular operations.

- Routine burn reduces USDC supply, aligns with market practices.

- Institutional redemption, no immediate adverse market effects noted.

Circle’s USDC Treasury burned approximately $135.6 million USDC on the Ethereum blockchain at 23:41 Beijing time, according to Whale Alert monitoring, as a routine supply adjustment.

The routine burn aligns with institutional redemption flows, reflecting standard operations rather than market distress, impacting USDC supply on Ethereum without indicating liquidity issues.

Circle’s $135.6M USDC Burn and Its Implications

Circle conducted a sizable USDC burn as part of routine treasury operations, involving a burn of approximately 135.6 million USDC on Ethereum. The involved parties include Circle Internet Financial, which is responsible for minting and burning USDC via its treasury wallets, and Whale Alert, which detected the transaction.

The primary change is a reduction in the USDC circulating supply on Ethereum, aligning with Circle’s model where redemptions lead to a 1:1 USDC to USD payout. Such burns are typical within Circle’s redemption cycle, with this event reflecting the flow of USDC back into fiat.

Jeremy Allaire, Co-founder & CEO of Circle, stated, “USDC is a fully backed stablecoin, redeemable one-to-one with USD. As part of normal operations, large burns like the recent ~$135.6M occur when institutions redeem USDC for fiat.”

The market reaction was neutral, with stakeholders recognizing the burn as routine and part of institutional activity. No significant commentary on this specific burn was released by Circle executives, and the action aligns with established USDC mint-burn mechanics.

Analyzing USDC Market Dynamics and Historical Trends

Did you know? In the past, USDC releases and burns often indicated market sentiment shifts. Stablecoin burns typically suggest investors are moving capital out of crypto, while increased minting correlates with bull phases.

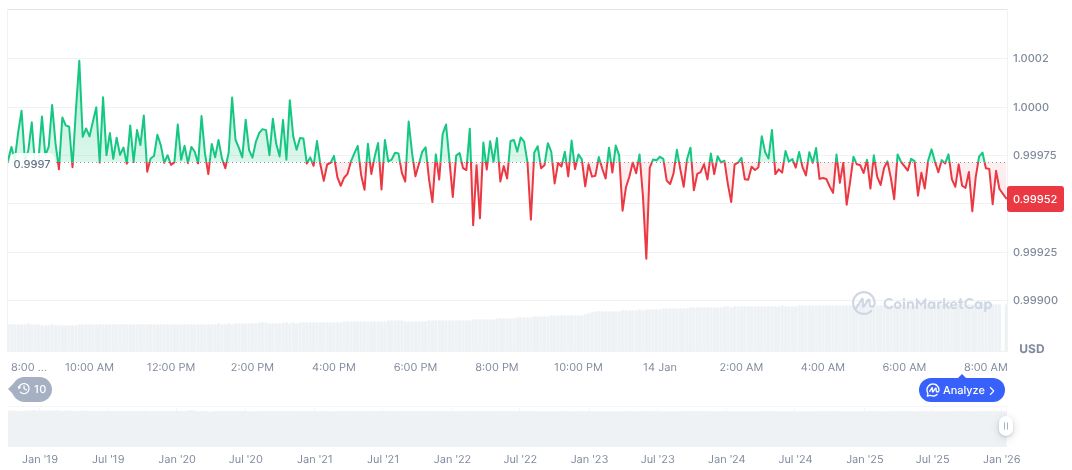

USDC, with a current price of $1.00 and a market cap of $75.22 billion, maintains a 2.3% market dominance. Its total market supply remains unrestricted, with recent fluctuations showing minimal change. CoinMarketCap data reveals a 24-hour trading volume of $22.75 billion, maintaining stability in the stablecoin market.

According to Coincu research, consistent USDC burns align with fiat movement trends and broader economic cycles. Regulatory developments on stablecoin reserves will continue to influence issuance/redeem dynamics and Circle’s treasury operations.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |