- Circle dismisses false claims of launching gold and silver trades.

- Fake press releases impacted USDC users’ trust.

- No change in USDC price; Circle emphasizes user safety.

Circle debunked a false press release about a tokenized metal trading platform called “CircleMetals” on December 24, clarifying that it had no such service, taking the fake site offline.

The incident highlights ongoing challenges with crypto scams, underlining the need for user vigilance against fraudulent schemes targeting assets like USDC.

Fake CircleMetals Release: No Legitimate Connection to Circle

Circle clarified that its brand and executives were falsely represented in a press release promoting ‘CircleMetals’. The associated website has since been taken offline, as reported by PANews on December 25th. No official statements from Circle executives, such as Jeremy Allaire, directly addressed this incident, but their communications urged caution.

The false press release targeted USDC holders, enticing them to swap USDC for non-existent GLDC and SILC tokens. While no actual financial impact on Circle is reported, the incident underscores the vulnerability that users may face from fake wallet connections and unverified links.

“Circle confirms that the announcement regarding the launch of ‘CircleMetals’ is fake, utilizing forged branding and executive quotes.” — Jeremy Allaire, Co-founder, Chairman, and CEO of Circle Internet Group

Market reactions saw no significant shifts in USDC’s value or Circle’s stock, with CRCL experiencing unrelated price movements due to external factors. Circle’s public messaging continues to emphasize user vigilance in avoiding scams that misuse the company’s identity.

Stablecoin Security Amid Scams and Regulatory Spotlight

Did you know? Other stablecoin issuers also faced similar impersonation scams, aiming to deceive users into draining their funds through fraudulent schemes.

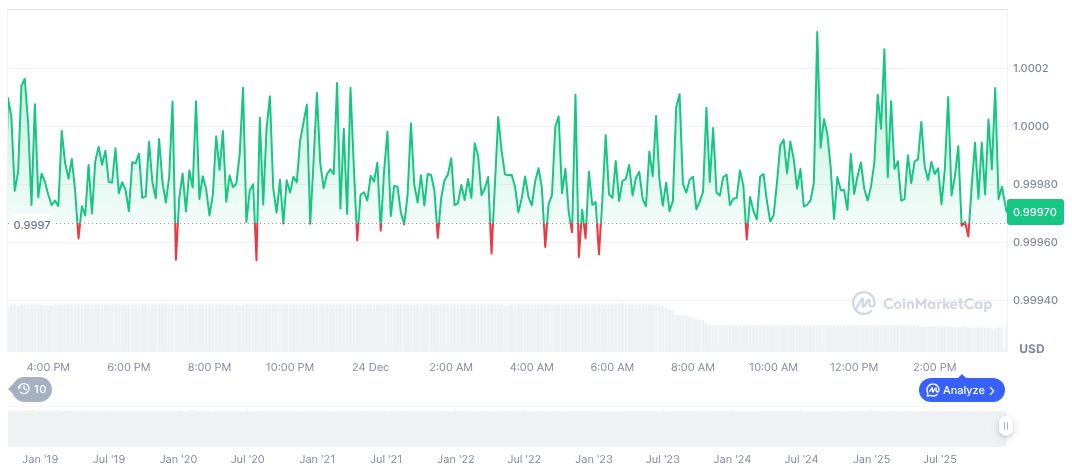

According to CoinMarketCap, USDC maintains a steady price of $1.00 with a market cap of $76.56 billion, holding 2.59% market dominance. Recent data shows minimal price fluctuations, emphasizing USDC’s stability amid its users’ exposure risk through fake token initiatives like CircleMetals.

Coincu analysts predict that while direct financial impact on Circle was limited this time, the ongoing threat of similar scams could propel regulatory bodies to establish stricter compliance frameworks to protect investors and uphold market integrity.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |