- Circle mints 1 billion USDC on Solana platform, expanding liquidity.

- USDC supply on Solana reaches 1.75 billion.

- No direct statements from Circle’s leadership available yet.

Circle has minted an additional 1.00 billion USDC on the Solana blockchain within the last 24 hours, increasing the total to 1.75 billion USDC on January 6, 2026.

This expansion enhances Solana’s liquidity for decentralized finance and trading activities, marking Circle’s first significant issuance of 2026, without immediate market reactions noted in primary sources.

USDC Supply on Solana Reaches 1.75 Billion

Circle issued a total of 1 billion USDC tokens on Solana in recent hours, raising the overall Solana-based USDC supply to 1.75 billion. Lookonchain data confirms this substantial issuance, reflecting Circle’s ongoing involvement in the Solana ecosystem. No official public commentary has emerged from Circle or Solana’s representatives regarding this activity.

Market analysts highlight potential opportunities for DeFi developers to leverage this liquidity boost on Solana. The cumulative mint of USDC now stands at 1.75 billion on Solana since the start of 2026.

Market watchers and investment communities have noted the expansion with neutral interest. Current market sentiment has not shown a significant shift, and no regulatory bodies have commented on or taken actions regarding this increase.

Circle’s mint on Solana illustrates the growing confidence in the platform’s ability to handle large-scale DeFi operations,” notes an anonymous market analyst.

Stablecoin Market Reacts to New Mint Activity

Did you know? Circle’s minting activity is part of a broader trend of increasing liquidity in decentralized finance ecosystems.

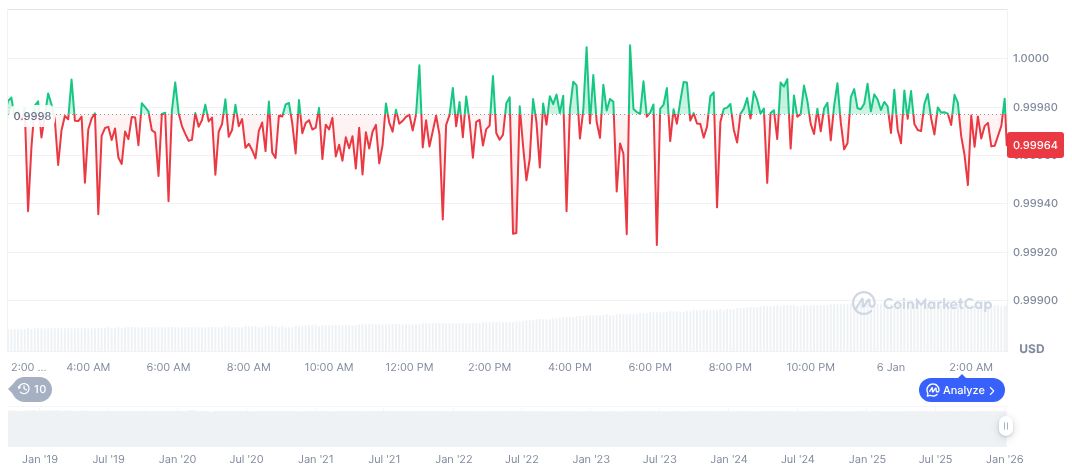

USDC holds steady at $1.00 with a market cap of approximately $75.70 billion, as per CoinMarketCap. The stablecoin shows minimal price fluctuations, with a 24-hour trading volume of $14.26 billion, marking a 4.40% increase. Over recent periods, price changes remain marginal, indicating stability. Data updated on January 6, 2026.

The Coincu research team suggests that this increase in USDC supply could lead to amplified DeFi activities. This may impact regulatory focus on stablecoin issuers like Circle and drive further blockchain infrastructure developments. Market dynamics remain neutral without significant disruption post-mint.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |