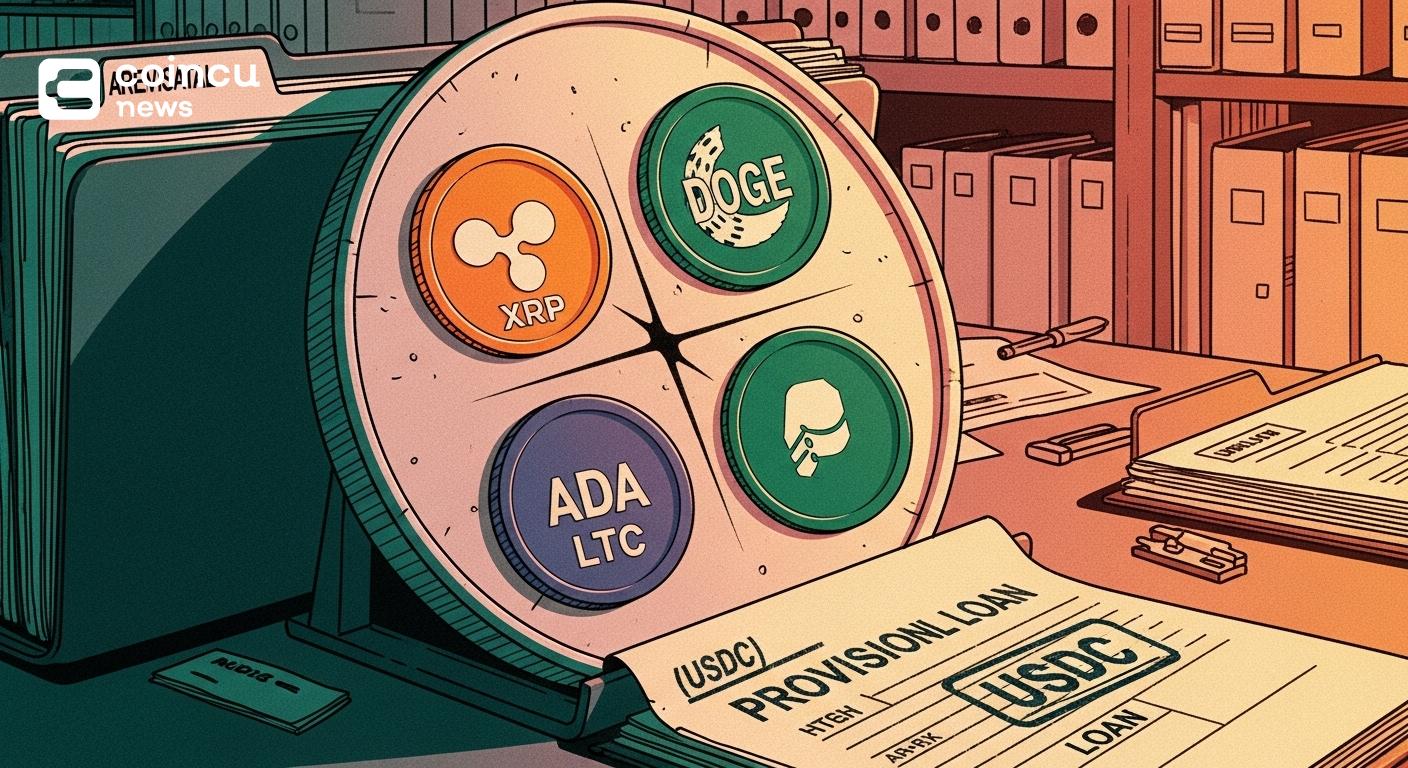

Coinbase expands on-chain lending: USDC loans with XRP, DOGE, ADA, LTC

According to the Block (https://www.theblock.co/post/390403/coinbase-xrp-dogecoin-cardano-litecoin-loans-morpho), Coinbase has expanded its on-chain lending product via Morpho, adding XRP, Dogecoin (DOGE), Cardano (ADA), and Litecoin (LTC) as eligible collateral. The integration enables borrowers to pledge these assets to obtain USDC loans on-chain while keeping their news/crypto/”>crypto positions intact.

The reporting notes eligible U.S. customers, excluding residents of New York, can borrow up to $100,000 in USDC without selling the supported tokens. Terms and parameters are subject to protocol settings and may evolve with market conditions.

Why it matters: $100,000 USDC without selling, U.S. users except New York

Borrowing against crypto rather than selling can preserve market exposure and may avoid triggering a taxable disposal, depending on an individual’s circumstances. For long-term holders, this structure unlocks liquidity while maintaining asset ownership.

Coinbase has framed the move as part of a broader effort to extend the utility of crypto collateral. “No matter what you’re holding, you should be able to leverage your crypto without having to sell,” said Jacob Frantz, Product Lead at Coinbase.

How Morpho-powered collateral, LTV, and liquidation mechanics affect borrowers

Morpho supports on-chain money markets where users post supported tokens as collateral to borrow USDC. Loan-to-value (LTV) parameters govern how much can be borrowed; if collateral value drops and health factors fall below thresholds, liquidations can occur.

Volatility is a central consideration for collateralized lending. An analysis highlighted that Litecoin declined roughly 54.92% over the past year, which can accelerate margin calls and liquidations when used as collateral, according to ainvest.com (https://www.ainvest.com/news/coinbase-collateral-flow-analysis-100k-loans-xrp-doge-ada-ltc-2602/).

Specific interest rates, LTVs, and liquidation thresholds for these markets were not detailed in the public reporting. Costs and mechanics can depend on Morpho market settings, utilization, and network fees, and may change over time.

FAQ about Coinbase on-chain lending

What are the borrowing limits, interest rates, LTV, and liquidation thresholds when using XRP, DOGE, ADA, or LTC as collateral?

LiveBitcoinNews reports U.S. users can borrow up to $100,000 in USDC against XRP, DOGE, ADA, or LTC (https://www.livebitcoinnews.com/coinbase-expands-onchain-loans-to-xrp-doge-ada-and-ltc/). Specific interest rates, LTVs, and liquidation thresholds were not disclosed and can vary by Morpho market parameters and utilization. Availability excludes New York based on prior reporting.

How do I borrow USDC via Morpho using my crypto on Coinbase, and what steps/fees are involved?

Public reports indicate borrowing occurs through Coinbase’s interface integrated with Morpho, using supported tokens as collateral for USDC. Exact steps, interest schedules, and fees were not specified; costs can include protocol interest and network fees. Eligibility applies to U.S. users outside New York.

At the time of this writing, COIN traded near $164.64 after-hours, based on data from Yahoo Finance.

Availability can change by jurisdiction; New York is excluded. Borrowers remain responsible for collateral volatility, margin calls, and potential liquidation.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |