Coinbase Exchange Sets Sights on India with Crypto Trading Relaunch

| Key Points: – Coinbase exchange has secured approval to offer digital asset trading in India and plans to relaunch its retail services by 2025. – India has stringent crypto regulations, including a 30% tax on trading gains and mandatory registration with the FIU, but policymakers are reconsidering their stance. |

Coinbase exchange has received approval to offer digital asset trading in India, marking a significant step toward re-entering one of the world’s largest cryptocurrency markets.

The development aligns with the company’s broader strategy to expand its global footprint and compete with major industry players like Binance.

Coinbase Exchange Gains Approval to Re-enter Indian Crypto Market

The U.S.-based crypto exchange first entered India in 2022 but withdrew a year later due to regulatory challenges. Now, Coinbase plans to relaunch its retail services in the country by 2025.

According to John O’Loghlen, Coinbase’s Regional Managing Director for APAC, India’s thriving developer community and entrepreneurial spirit make it an attractive market for blockchain and cryptocurrency innovation.

The renewed push of Coinbase exchange into India also includes plans to expand its workforce. CEO Brian Armstrong recently announced the company’s intention to hire over 1,000 employees in 2025. The announcement followed Armstrong’s participation in the Trump administration’s inaugural Crypto Summit at the White House, where industry leaders discussed the future of digital assets.

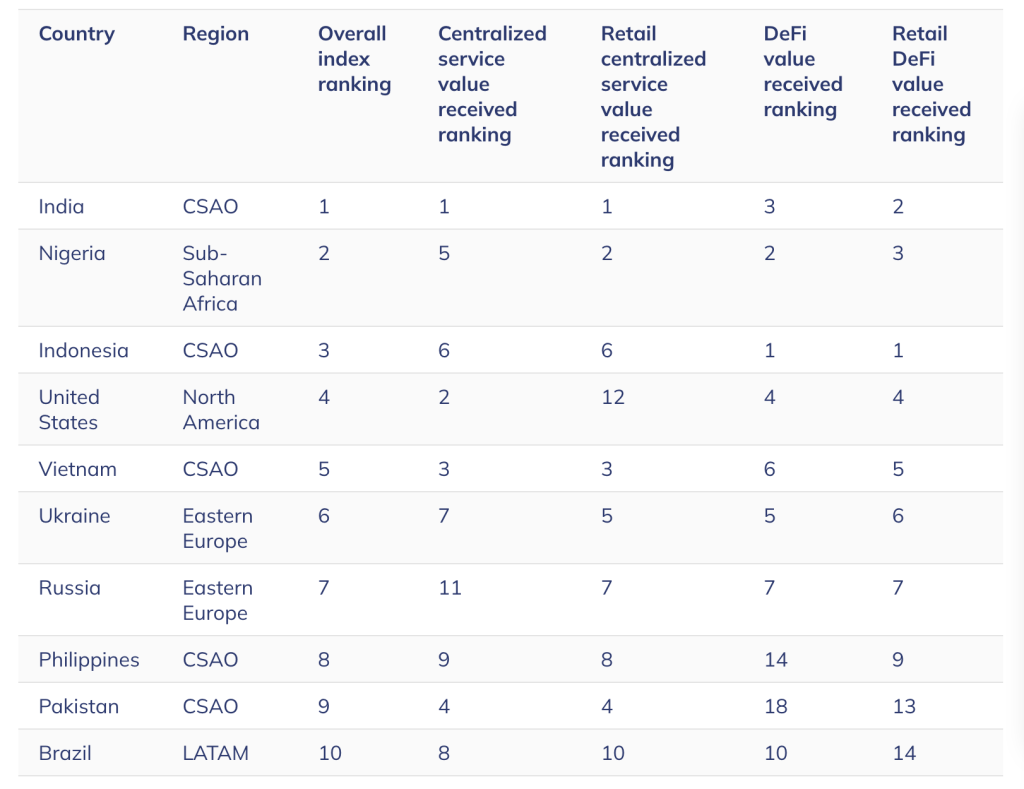

India has emerged as a global leader in grassroots crypto adoption, according to a 2024 Chainalysis report. The report highlights the country’s strong DeFi sector and its significant pool of blockchain talent. Data from Coinbase exchange also indicated that 12% of the world’s on-chain developers were based in India as of 2023.

Shifting Global Policies and India’s Evolving Crypto Stance

Binance, the world’s largest cryptocurrency exchange, also made strides in India last year. After registering with the country’s Financial Intelligence Unit (FIU), Binance resumed operations in August 2024. Before reopening in India, the exchange faced a fine of 188.2 million rupees ($2.25 million) for regulatory non-compliance.

India’s regulatory landscape for digital assets remains complex. Virtual digital asset service providers, including crypto exchanges, must register with the FIU and adhere to anti-money laundering requirements.

Additionally, India imposes a 30% tax on crypto trading gains, one of the highest rates globally. Despite these challenges, policymakers are reassessing their stance on cryptocurrency, driven by global regulatory changes and a shifting perspective in the U.S. following Donald Trump’s election victory.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |