- Community banks call for GENIUS Act amendment; stablecoins potentially circumventing interest restrictions.

- Stablecoins “effectively pay interest,” contradicting bill’s intent, say banks.

- Industry groups warn that tighter rules could hamper innovation and consumer choice.

American community banks urge Congress to amend the GENIUS Act, citing regulatory gaps allowing stablecoins to offer indirect interest through exchanges, impacting banking competitiveness.

This push for modifications highlights tensions between traditional banks and the crypto sector over regulations affecting deposits and innovation, potentially influencing future legislative directions.

Community Banks Urge Legislative Clarity on Stablecoins

In a letter to the Senate, the Community Bank Council of the American Bankers Association advocated for altering the GENIUS Act. They argued certain stablecoin issuers are circumventing interest prohibitions by granting yields through third parties such as digital asset exchanges. The GENIUS Act clearly bans stablecoin issuers from directly offering interest to holders to protect traditional bank savings accounts from undue competition.

The American Bankers Association emphasized clarity in the upcoming legislation concerning any affiliates of stablecoin issuers that might provide yields. This suggestion aligns with earlier remarks by the Banking Policy Institute which shared apprehensions about potential deposit outflows from the traditional banking sector.

“It’s crucial that regulations evolve to accommodate the rapid pace of financial innovation, while ensuring consumer protection and market stability,” emphasized a representative from the Banking Policy Institute.

Blockchain Industry Defends Stablecoins Against Regulatory Hurdles

Did you know? The GENIUS Act was signed into law in July 2025 and is set to be enforced in November 2026. This timeline was established in response to regulatory challenges faced by stablecoins, similar to the impact raised by the TerraUSD collapse in 2022.

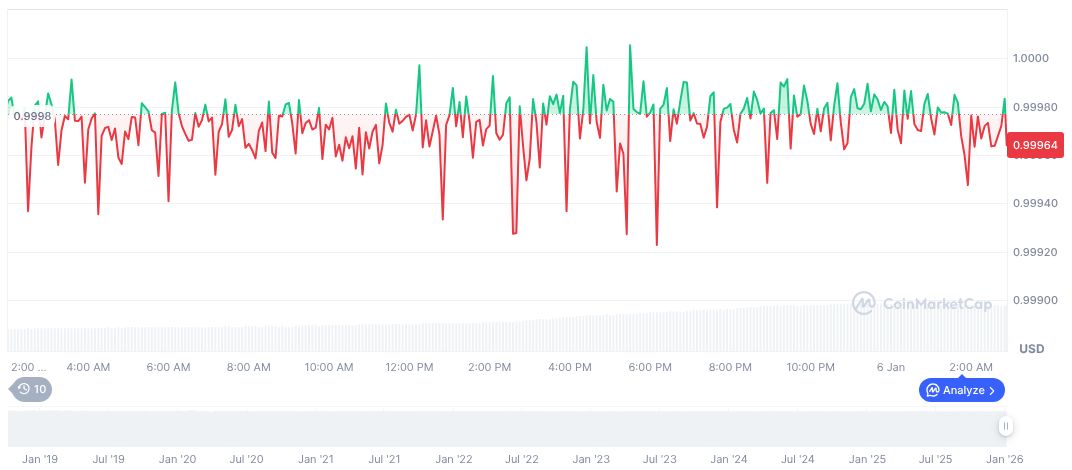

USDC, a prominent stablecoin, maintains a stable value of $1.00 with a market cap nearing $75.72 billion, securing a 2.39% market dominance. Over the past 90 days, it experienced a slight decrease of 0.03% according to CoinMarketCap, indicating modest volatility in its valuation amid sector discussions.

Coincu research suggests the amendments could differentiate the use of stablecoins in traditional banking versus purely digital transactions. Financial outcomes may involve tighter integration between crypto platforms and banks, ensuring compliance whilst supporting innovation.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |