- U.S. senators and CEOs discuss cryptocurrency market structure and stablecoin regulation.

- Key meeting includes Bank CEOs and senators on stablecoin interest issues.

- Immediate implications for stablecoin issuers and banking affiliates globally.

U.S. senators and top bank CEOs gather at the White House today to deliberate the “Cryptocurrency Market Structure Bill,” focusing on stablecoin interest payments and regulatory issues.

The meeting could significantly impact stablecoin issuers and the broader crypto market, influencing regulatory frameworks, investment strategies, and U.S. financial institutions’ roles in digital assets.

White House Talks Focus on Stablecoin Regulations

Reports indicate intense discussions at the White House involving major crypto industry figures and U.S. senators. This meeting focuses on proposed regulations for stablecoin issuers and restrictions on interest-related payments. Bank CEOs are actively participating to convey the potential implications for financial institutions.

Changes in the regulatory landscape could affect stablecoin issuers’ affiliates’ ability to make interest payments, leading to possible structural shifts in how these entities operate. This development might influence how U.S.-based banks interact with the crypto sector overall.

“We must prioritize consumer protection in the crypto market and ensure that no one gets left behind in this evolving financial landscape.” — Senator Sherrod Brown, Chair, Senate Banking Committee.

Sen. Tim Scott, on the other hand, emphasizes safeguarding market stability while enabling innovation.

Historical Context, Price Data, and Expert Analysis

Did you know? The last time U.S. regulations focused on cryptocurrency structure, stablecoins saw a potential shift towards offshore markets to avoid stringent restrictions.

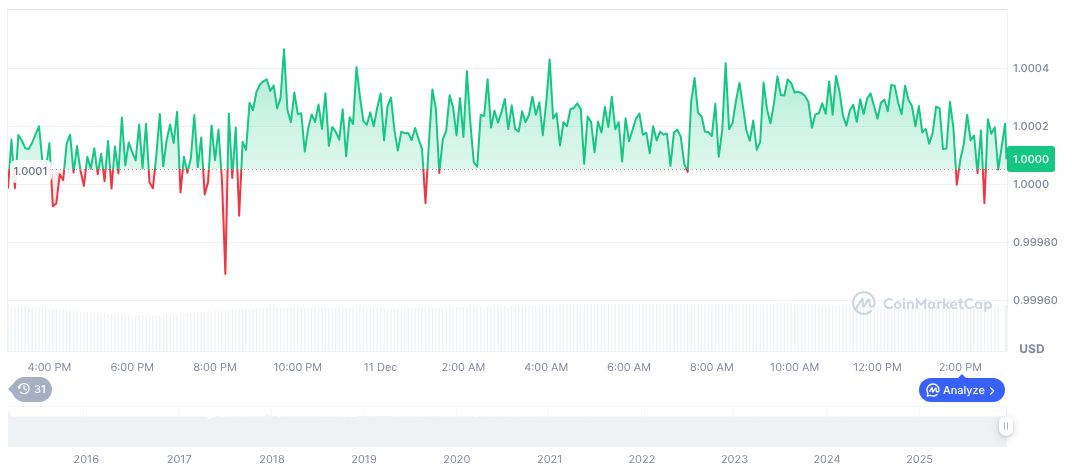

CoinMarketCap data shows Tether USDt (USDT) holding a market cap of 186,093,436,949 with a stable price of $1.00 as of December 11, 2025. Its 24-hour trading volume reached 111,882,863,980, marking a 0.72% change.

The Coincu research team suggests that if regulatory measures reduce stablecoin profitability, this could shift innovation to onshore non-bank issuers or encourage international adaptations to maintain market competitiveness.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |