Global Digital Asset Inflows Reach $47.2B in 2025 as Altcoins Surge

In Brief

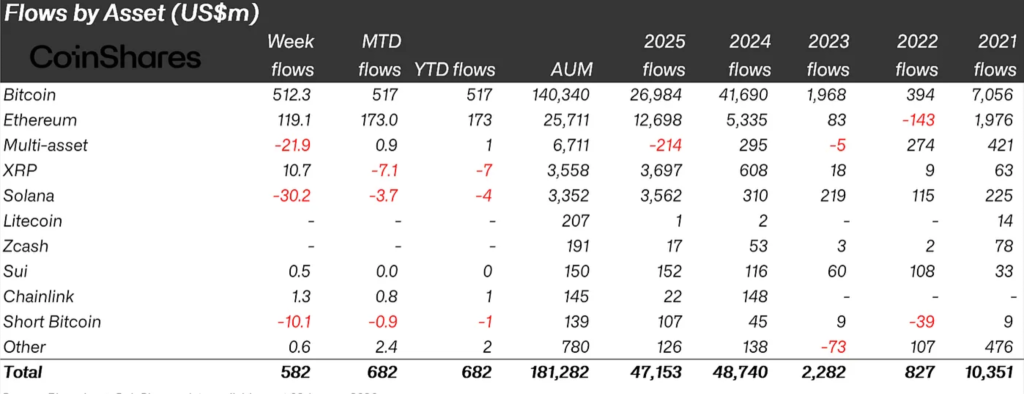

- Ethereum, XRP, and Solana saw inflows surge, while Bitcoin inflows fell 35% in 2025

- Germany and Canada reversed 2024 outflows, adding $2.5B and $1.1B in new inflows

- Global crypto fund inflows reached $47.2B in 2025, just short of 2024’s record $48.7B

Global digital asset investment products closed 2025 with $47.2 billion in total inflows, nearly matching 2024’s record. Despite early-week outflows, a strong Friday performance helped secure $582 million in net inflows for the first week of 2026.

The data highlights shifting investor interest, with notable growth in select altcoins and weakening dominance from Bitcoin. Bitcoin saw a 35% drop in yearly inflows, ending 2025 with just $26.9 billion allocated to investment products.

Short-Bitcoin products attracted $105 million as prices dropped, though assets under management remained relatively small. Meanwhile, Ethereum gained $12.7 billion in inflows, up 138% year-on-year, maintaining strong interest across institutional buyers.

XRP and Solana recorded explosive growth, with inflows increasing 500% and 1,000%, respectively, over the year. Other altcoins saw reduced sentiment, recording a 30% year-on-year drop in inflows to just $318 million.

The shift signals investor preference for a few leading altcoins while reducing exposure to the broader altcoin market.

Germany and Canada Rebound as Regional Inflows Diversify

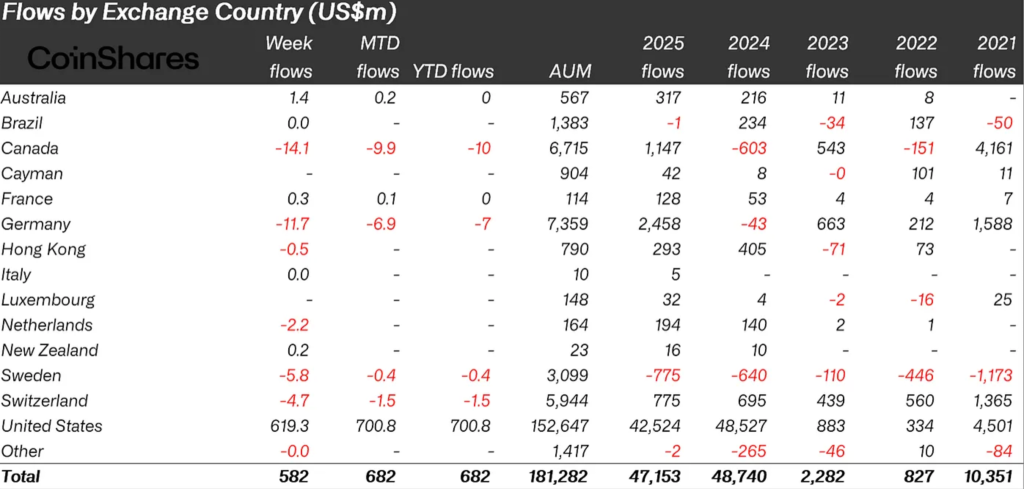

The U.S. led global inflows with $47.2 billion, despite a 12% decline compared to 2024 levels.

Germany reversed its previous position with $2.5 billion in inflows, after recording $43 million in outflows in 2024. Canada followed a similar path, recovering to $1.1 billion in inflows from $603 million in outflows the prior year.

Switzerland saw steady performance, recording an 11.5% increase in yearly inflows to $775 million in 2025. These regional rebounds show a broader recovery in investor confidence beyond the U.S.-centric flow dominance.

Analysts suggest further expansion into Asia and Europe could create a more stable base for long-term market growth. Looking ahead, analysts emphasize flow sustainability as a more important indicator than temporary price action.

They expect the quality and distribution of capital flows to shape long-term trends across digital asset markets. Diversified inflows across regions and asset types are likely to define the next phase of market maturity.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |