- Proposal for 17.45 million CRV submitted for Curve upgrades.

- Funds intended for 2026 developments and open-source releases.

- Potential market influence on CRV volatility remains uncertain.

Michael Egorov, founder of Curve Finance, submitted a proposal on December 15 requesting 17.45 million CRV worth $6.6 million for development funding to Swiss Stake AG.

The proposal aims to enhance Curve’s infrastructure by 2026, including launching Llamalend v2 and on-chain FX functions, potentially impacting the CRV market dynamics.

Curve Finance Seeks $6.6 Million for Protocol Upgrades

Michael Egorov’s proposal for 17.45 million CRV seeks DAO approval to fund upgrades for Curve protocols through Swiss Stake AG. The upgrades planned include Llamalend v2 and progress in on-chain foreign exchange functionality. All developments aim to release their findings openly to support the wider crypto community. Egorov shares his vision, stating, “Good question! I still don’t really know today. Looks as hard to know as Satoshi’s identity.”

Funds will aid a team of 25 coupled with the possibility of staking the CRV funds for additional returns. The proposal highlights a strategic development phase for Curve, expected to function through 2026, while aiming to enhance existing protocols.

Community and market reaction remains muted, lacking significant commentaries from officials or influencers. The proposal, if supported, may strengthen Curve’s position, considering the financial pressures exerted in previous liquidation events.

CRV’s Market Position and Potential Regulatory Impacts

Did you know? Curve Finance’s current proposal aligns with historical efforts to infuse liquidity and expand capabilities, reflecting past initiatives like the OTC CRV sales to mitigate debt risks.

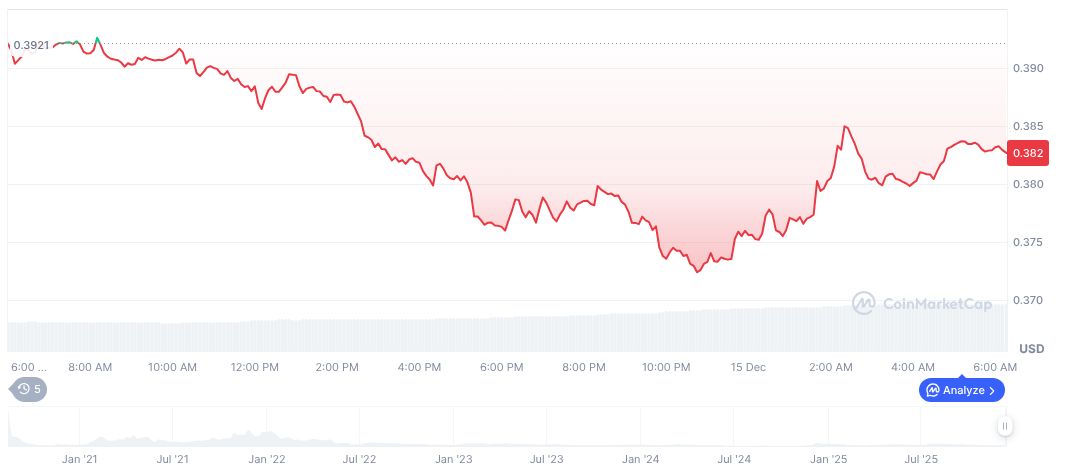

As reported by CoinMarketCap, CRV’s current price stands at $0.38, with a market cap of $545.19 million. The CRV’s 24-hour volume has seen a 58.65% rise, totaling $61,228,979. Recent data indicates a 48.09% decline over the past 90 days, reflecting ongoing market volatility.

The Coincu research team highlights potential outcomes if the proposal garners approval: regulatory clarity and expanded DeFi functionalities. Such developments can bolster technological integration, supporting ongoing market expansion and user engagement across DeFi infrastructure.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |