DOJ Releases Jeffrey Epstein Investigation Documents, Caution On Personal Info

- The DOJ released Epstein investigation documents with identity redactions.

- Potential inadvertent disclosure remains a concern.

- Document review reveals over 1,200 victims and families.

The U.S. Department of Justice released investigation documents related to the Epstein case on December 20, with efforts to redact personal information, despite potential inadvertent disclosures.

This release marks significant progress in the investigation, although no immediate connections to cryptocurrency markets or blockchain events were identified, highlighting careful redaction processes.

DOJ Unveils Thousands of Epstein Case Files

The U.S. Department of Justice unveiled thousands of pages from the Epstein investigation, emphasizing efforts in redacting victims’ information. Deputy Attorney General Branch highlighted over 1,200 affected individuals. The department aims to ensure utmost privacy despite releasing the documents.

Potential leaks have sparked concerns. Branch cautioned about potential inadvertent releases, emphasizing ongoing privacy efforts. Full disclosure might take weeks, aligning with the agency’s transparency commitment. In past document disclosures, the DOJ faced similar challenges of balancing transparency while safeguarding personal data, highlighting the complexities involved in high-profile investigations.

Government reactions remain focused on maintaining privacy. The DOJ’s document disclosure stirred attention, but community voices in crypto and related sectors remain silent. The absence of statements from crypto figures underscores this event’s non-impact on the industry.

Minimal Market Response to DOJ’s Document Release

Did you know? In past document disclosures, the DOJ faced similar challenges of balancing transparency while safeguarding personal data, highlighting the complexities involved in high-profile investigations.

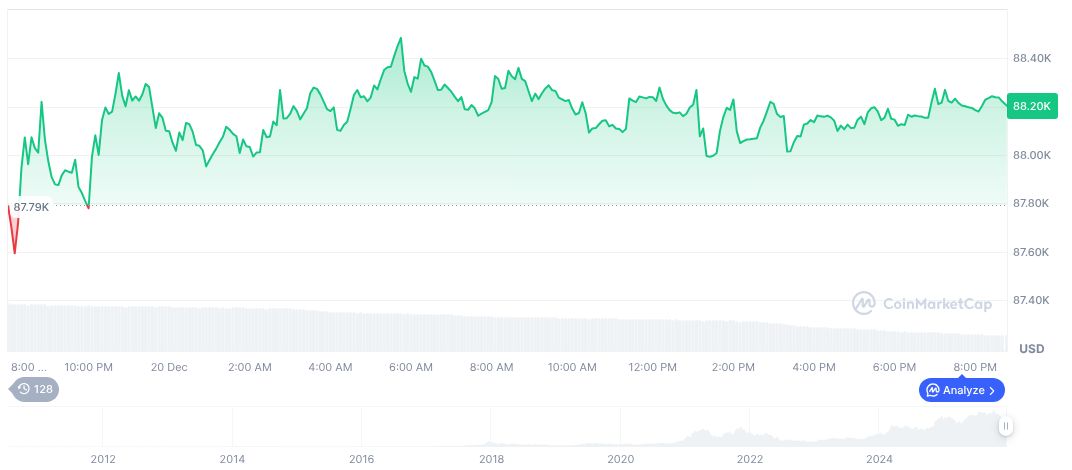

Bitcoin’s market data shows a current price of $88,285.73, with a market cap of [CoinMarketCap](https://coinmarketcap.com) formatNumber(1_762_610_281_653, 2). Despite a 24-hour trading volume decrease of -66.47%, Bitcoin’s dominance at 58.96% remains significant, although the price reflects fluctuations attributed to CoinMarketCap.

According to Coincu analysts, regulatory impacts from the DOJ’s actions remain minimal on markets. Cryptocurrencies show stability during such legal disclosures, suggesting that internal blockchain events or technological shifts usually concern impact more than external legal releases.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |