- DTCC partners with Canton Network for tokenization of U.S. Treasury securities.

- SEC approves project; MVP expected early 2026.

- Potential to enhance market liquidity and transparency.

DTCC has teamed up with Canton Network to tokenize U.S. Treasury assets, announcing plans for a minimum viable product by 2026 after receiving an SEC “no objection” letter.

This partnership could transform asset liquidity and efficiency, signaling a major shift in the financial sector towards blockchain-based solutions for real-world asset tokenization.

DTCC and Canton Network Secure SEC Approval for Tokenization

The partnership between DTCC and Canton Network aims to develop tokenization of U.S. Treasury assets. This collaboration was announced following a “no objection” letter from the SEC, intending to launch a minimum viable product (MVP) in 2026.

Changes expected from this move include increased market liquidity and operational transparency. The project envisions expanding tokenization to other DTC-eligible assets based on customer demand, ultimately facilitating broader asset modernization.

While no immediate market reactions have been reported, key figures like Frank La Salla, CEO of DTCC, have expressed optimism in co-leading real-world asset tokenization. The announcement has yet to spark widespread industry responses or significant developer discourse.

Historical Trends in Asset Modernization and Market Data

Did you know? Tokenization of U.S. Treasury assets by the DTCC aligns with industry trends toward asset digitalization, aiming to enhance efficiency similarly to past innovations in electronic trading platforms.

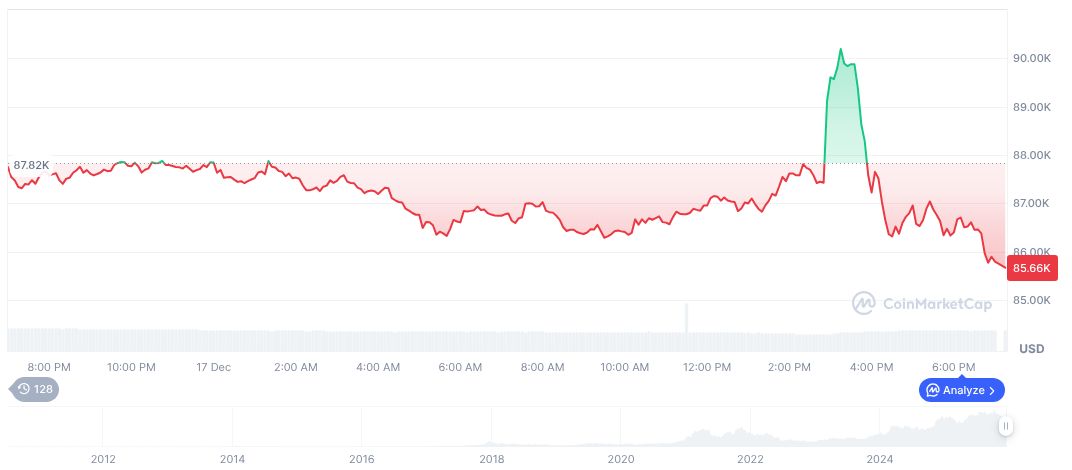

Bitcoin’s current price is $85,392.62, with a market cap of 1,704,730,858,648.51, representing a 59.07% market dominance. Recent data shows a 24-hour trading volume of 41,763,241,034.66, marking a 9.05% decrease. Last updated figures highlight declines of 2.32% over 24 hours and 27.53% over 90 days, according to CoinMarketCap.

Insights from the Coincu research team suggest that the partnership could lead to new financial models and regulatory adaptations, providing enhanced asset portfolio efficiency. Historical data indicates that adopting blockchain technologies often increases transparency and reduces operational costs.

“This collaboration creates a roadmap to bring real-world, high-value tokenization use cases to market, starting with U.S. Treasury securities and eventually expanding to a broad spectrum of DTC-eligible assets across network providers,” said Frank La Salla, CEO of DTCC. source

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |