- Exor rejects Tether’s bid for its Juventus stake.

- No intention to sell shares.

- Juventus valued at 1.1 billion euros.

On December 14, Exor N.V. rejected Tether Investments’ proposal to acquire its 65.4% stake in Juventus Football Club, reaffirming their long-term commitment to the club.

The decision reinforces Exor’s dedication to Juventus, impacting potential market dynamics and demonstrating the family’s enduring influence over Italy’s top football institution.

Exor Board Unanimously Rejects Tether’s €2.66/Share Proposal

Exor N.V., the holding company under the Agnelli family’s control, rejected an acquisition proposal from Tether Investments, S.A. de C.V. The proposal entailed a 2.66 euros per share offer for Juventus, amounting to a 1.1 billion euro valuation. This offer was unanimously rejected by Exor’s Board of Directors, saying,

Exor N.V. announces that its Board of Directors has unanimously rejected an unsolicited proposal submitted by Tether Investments, S.A. de C.V. to acquire all of the shares of Juventus Football Club S.p.A. owned by Exor. – Exor Press Release

Exor’s decision to retain its holdings implies a continued belief in Juventus’s current trajectory and future growth under the new management team. The rejection of Tether’s bid maintains the status quo for both Juventus and its stakeholders, albeit under a focused vision guided by the Agnelli family.

Market responses have remained muted, given the firm rejection statement from Exor. Juventus shares, which traded at 2.19 euros before the offer, remain unaffected by the proposal’s dismissal, showcasing investors’ alignment with Exor’s commitment to the club’s future under its current leadership.

Agnelli Ownership of Juventus to Continue Amid Crypto Interest

Did you know? The Agnelli family has maintained control of Juventus for over a century, highlighting the historical significance and strategic value of the club beyond sheer financial metrics.

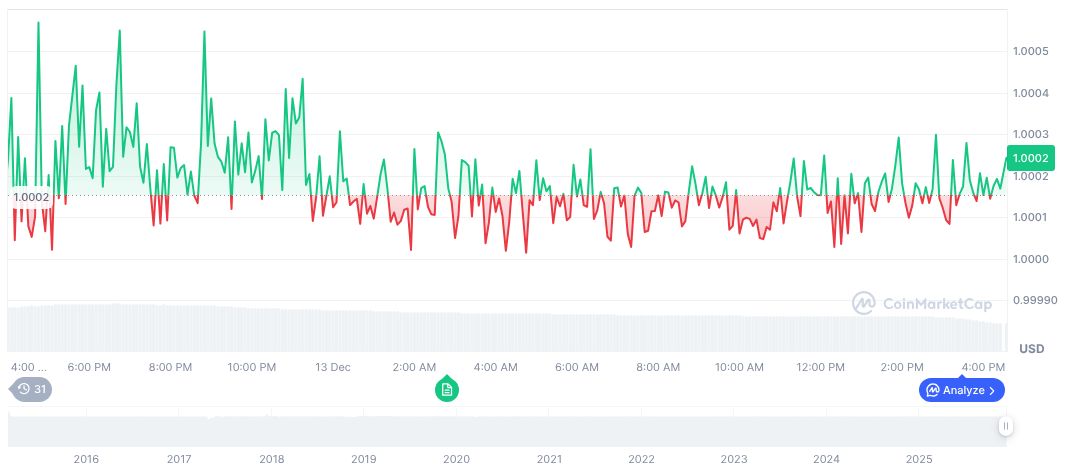

Tether (USDT) remains stable at $1.00 with a market cap of approximately $186.25 billion, holding a 6.06% market dominance. Despite the proposal’s rejection, USDT’s circulating supply exceeds 186.21 billion tokens, indicating robust demand and liquidity within crypto exchanges, as reported by CoinMarketCap.

According to the Coincu research team, the ongoing retention of Juventus by Exor suggests minimal direct financial disruptions. However, the persistent interest from Tether highlights potential for future mergers or acquisitions involving traditional sports entities and digital financial firms. Such interest illuminates evolving dynamics at the intersection of finance and sports industry ownership.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |