- FASB’s 2025 project explores stablecoins as cash equivalents by 2026.

- Potentially impacts USDT and USDC classifications.

- Institutions may alter digital asset strategies based on outcomes.

The Financial Accounting Standards Board (FASB) plans to evaluate stablecoins as ‘cash equivalents’ by 2026, while assessing accounting methods for cryptocurrency transfers, including Wrapped Tokens.

This exploration could redefine stablecoin classifications, impacting assets like USDT and USDC in accounting practices, amid growing institutional interest in cryptocurrencies.

FASB’s New Agenda: Stablecoins as Cash by 2026?

The Financial Accounting Standards Board (FASB) has initiated efforts to assess if certain stablecoins should be designated as “cash equivalents” by 2026. The board’s inclusion of this project in their technical agenda signals anticipated changes in cryptocurrency accounting practices.

Should the FASB alter stablecoin classification, it would affect the accounting of major digital assets like USDT and USDC. Additionally, the recognition of wrapped tokens in transfer accounting could see significant shifts in market perceptions.

Unfortunately, the provided information does not contain any specific quotes from individuals associated with FASB or key opinion leaders (KOLs) in the cryptocurrency space, as no primary sources were identified with direct statements or reactions. Therefore, there are no quotes to extract based on the current data.

Market Implications and Expert Opinions on FASB’s Stablecoin Move

Did you know? In 2024, FASB’s Accounting Standards Update reformed crypto accounting rules but avoided stablecoin classifications, paving the way for the current initiative.

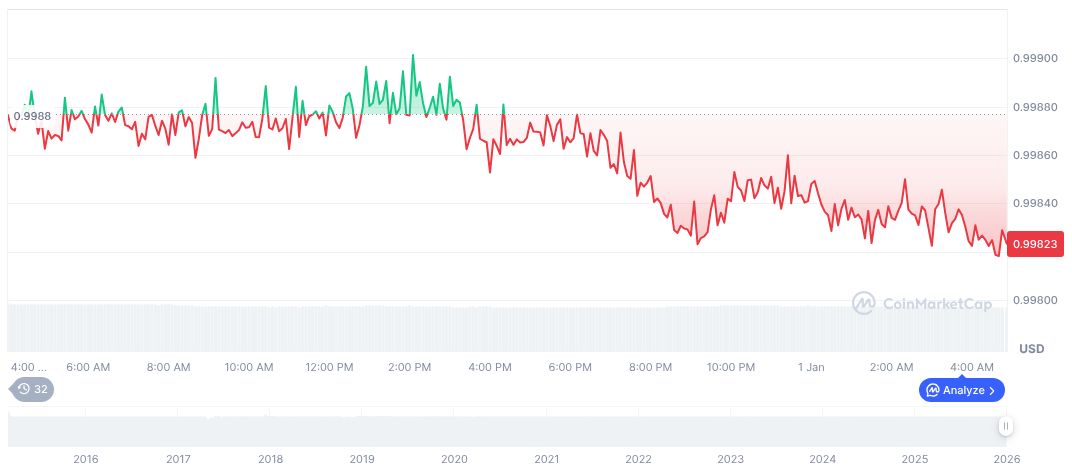

As reported by CoinMarketCap, Tether USDt (USDT) currently stands at a price of $0.99 with a market dominance of 6.31%. The stablecoin experienced slight price decreases of 0.04% over the past 24 hours and 0.10% over 7 days. It holds a market cap of formatNumber(186786741785, 2).

According to Coincu research, the potential reclassification by FASB could reshape market dynamics and financial reporting approaches. This would likely impact investor perception and regulatory adherence, marking a significant evolution in how digital assets are managed in official financial records.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |