- UK aims to regulate stablecoins to drive economic growth.

- Plan finalizes by 2026.

- Includes digital asset rules, sterling stablecoins.

The UK Financial Conduct Authority (FCA) revealed plans on December 11 to prioritize regulation of fiat-pegged stablecoins, aiming for finalized rules by 2026.

This initiative underscores the UK’s effort to integrate blockchain in traditional finance while safeguarding consumer interests and maintaining market integrity, impacting global stablecoin issuers significantly.

FCA Targets Stablecoin Regulation by 2026

The FCA’s latest communication outlined stablecoins’ role in the broader UK economic agenda. Focusing on fiat-pegged stablecoins like those tied to the US dollar or British pound, the FCA aims to develop detailed regulations by 2026. This effort is part of a broader initiative to digitize financial services and bolster trade competitiveness.

Significant actions include advancing digital asset rules and sterling stablecoins. The migration of traditional assets to blockchain and enabling tokenization in asset management are also key focuses. Nikhil Rathi, FCA CEO, noted the dual aim of growth support with consumer protection in mind.

“Supporting UK‑issued stablecoins is central to faster and more convenient payments and part of our growth agenda.” — Nikhil Rathi, FCA CEO

Market reactions have been cautious but optimistic. Industry players highlight the potential positive impacts on financial stability and innovation. However, specifics on compliance and operational changes remain points of interest for stakeholders.

UK Aims for Law-Compliant Innovation in Blockchain

Did you know? In 2025, the UK outlined plans for systemic stablecoins, marking a significant regulatory shift towards integrating stablecoins into traditional financial infrastructure.

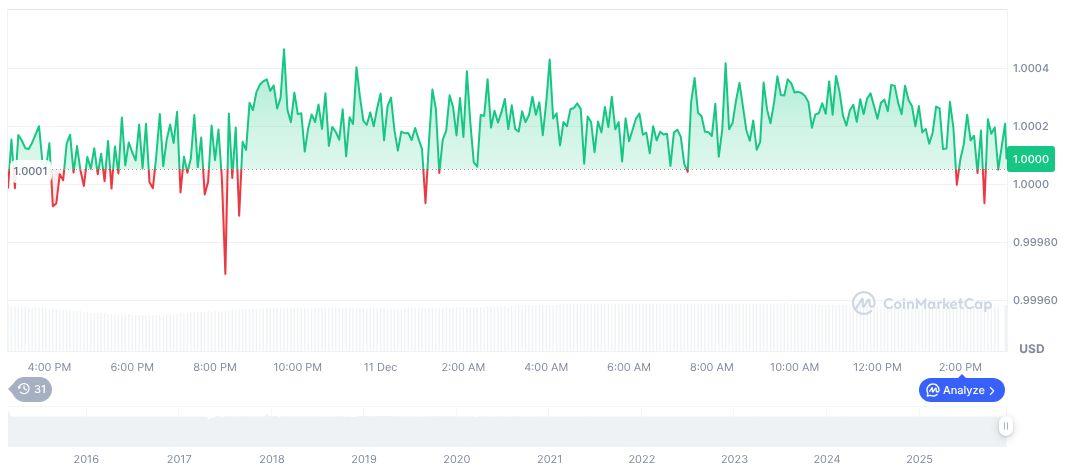

As of December 11, 2025, Tether USDt (USDT) holds a market cap of formatNumber(186117117011, 2) and a dominant position at 6.09%, according to CoinMarketCap. The token’s 24-hour trading volume stood at formatNumber(112880572973, 2) with a negligible 0.02% price fluctuation, demonstrating its stability in the market.

Financial analysts anticipate that by creating a regulated environment for stablecoins, the UK can position itself as a law-compliant innovation hub. The regulatory clarity provided by the FCA will likely attract institutional interests in tokenization projects moving onto blockchain infrastructure.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |