- Fed’s December rate cut faces opposition over inflation concerns.

- Evans calls for more data before policy shifts.

- Implications for cryptocurrency markets with potential policy reversal.

Chicago Fed President Charles Evans opposed the Federal Reserve’s December 25 basis point rate cut, advocating for additional data analysis on inflation and labor market conditions amid persistent price concerns.

This stance reflects ongoing divisions within the Federal Open Market Committee (FOMC), impacting assets like Bitcoin and Ethereum as investors anticipate future Federal Reserve monetary policy shifts.

Fed Rate Cut Debate Amid Historical Inflation Concerns

Charles Evans, former President of the Federal Reserve Bank of Chicago, expressed his opposition to the 25 basis point rate cut during the December 2025 FOMC meeting, emphasizing the need for more comprehensive data on inflation and the labor market. Federal Reserve officials remain divided on the path forward, with some advocating for larger cuts due to ongoing inflationary pressures.

The division within the Federal Reserve signals caution amid inflation levels exceeding the 2% target, which has led to differing views on the extent of rate cuts. Discussions and dissents seem prevalent, with expectations of a potential pause on the horizon in 2026, as indicated by the latest FOMC meeting minutes.

I believe we need more data on inflation and labor market conditions before further easing amid persistent price concerns. – Charles Evans

Market reactions are mixed, with BTC and ETH among risk assets affected by rate decisions. The CME FedWatch tool indicates a 90% likelihood of a 25 basis point cut, suggesting cautious optimism tempered by inflation concerns. Market participants await Fed Chair Jerome Powell’s upcoming press conference for further insights.

Cryptocurrencies React to Fed’s Policy Shifts

Did you know? The split within the Federal Reserve regarding rate cuts has historical precedence, with similar divisions noted in September and October 2025, reflecting ongoing challenges in balancing employment concerns with inflation control.

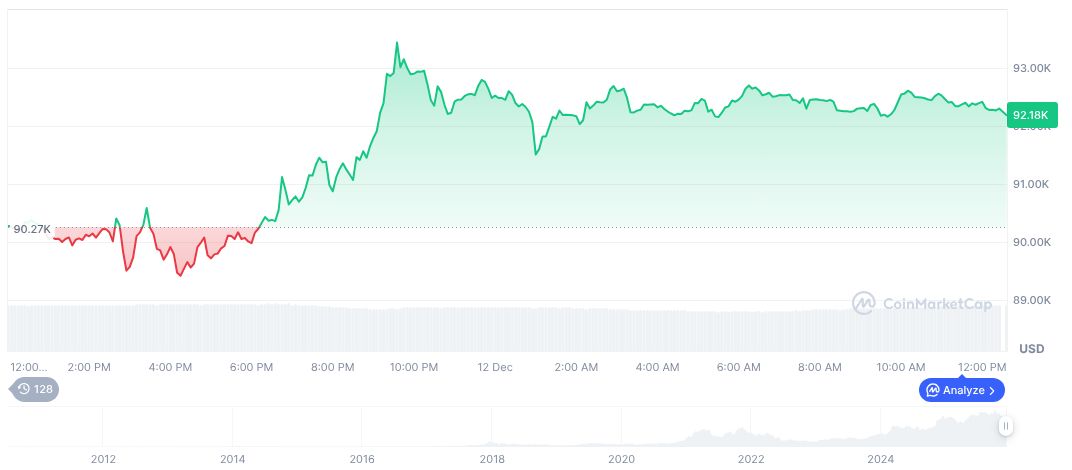

Bitcoin (BTC) is currently priced at $89,997.53 with a market cap of $1.80 trillion and a market dominance of 58.69%, according to CoinMarketCap. The recent 24-hour trading volume reached $79.97 billion, marking a 14.73% change. In the past 60 days, BTC has decreased by 21.44%, with the last update recorded at 17:31 UTC on December 12, 2025.

According to Coincu research team insights, the potential slowdown in rate cuts could support BTC and ETH prices in the short term, as reduced borrowing costs remain beneficial for risk assets. However, inflationary pressures and policy uncertainty could limit potential gains in the foreseeable future.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |