- Federal Reserve proposes lite master accounts for legally qualified institutions including fintechs.

- Institutions gain direct payment system access without partner banks.

- Potentially increased institutional involvement in finance sector.

At the Federal Reserve’s Payment Innovation Conference on October 21, Governor Chris Waller proposed a ‘lite master account’ for qualified institutions, signaling a shift in financial access policies.

This proposal could streamline financial innovation, benefiting fintech and stablecoin entities by offering direct Federal Reserve payment system access, boosting integration with traditional financial systems.

Fed’s Lite Accounts Open Doors for Fintech Innovation

Governor Chris Waller’s announcement of the lite master account targets legally qualified institutions, encompassing fintech companies and stablecoin issuers. The aim is to allow them direct access to the Federal Reserve’s payment system without requiring a partner bank. The proposal’s significance lies in allowing these entities to operate more freely within the traditional financial infrastructure. Unlike a full master account, the lite version limits access to certain services such as Fed borrowing but retains unchanged eligibility rules. Institutions like Custodia Bank, which previously filed a lawsuit against the Fed, and others like Kraken, waiting for master account approvals, likely view this as a favorable shift.

Changes stemming from this proposal potentially include increased institutional participation in the financial sector, especially from fintech and stablecoin entities. This could streamline processes for companies that have struggled to secure traditional banking partnerships, spurring innovation across the industry.

Governor Chris Waller announced: ‘This proposal aims to grant direct access to the Federal Reserve’s payment system to legally qualified institutions, potentially including fintech companies and stablecoin issuers.’

Reactions in the market and community remain cautiously optimistic. The broader sentiment reflects anticipation of regulatory environments becoming more inclusive of financial technology advancements. Agencies and professionals within the space may perceive the Fed’s move as maintaining an encouraging environment for innovation.

Historical Parallels Highlight Growing Fintech Access

Did you know? The concept of lite master accounts is reminiscent of earlier shifts aimed at expanding access within the Federal Reserve system, historically demanding partner banks for such integration.

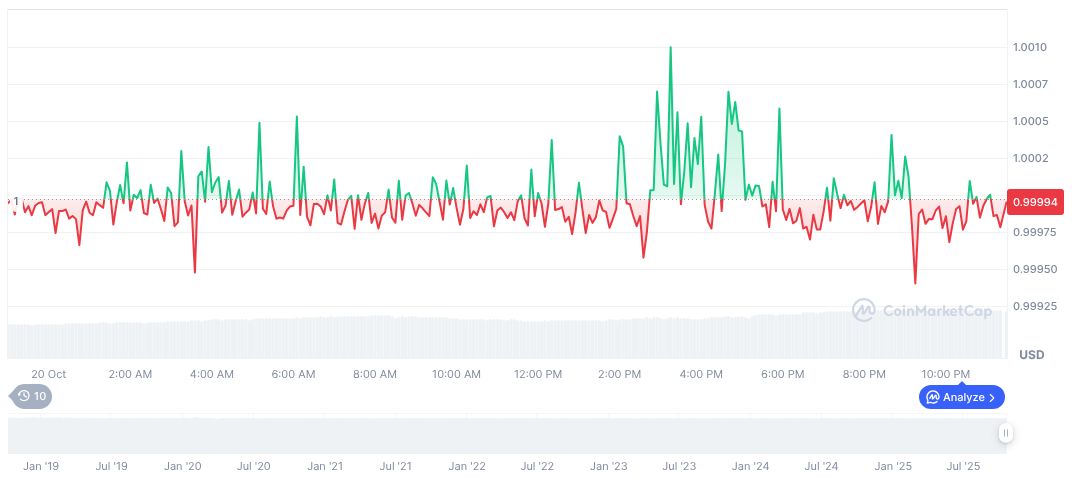

According to CoinMarketCap, USDC’s current price sits at $0.99 with a market cap of formatNumber(76199311296, 2). Despite minimal fluctuations over the past 90 days, its 24-hour trading volume reached formatNumber(17599153449, 2), making up 23.43% of its activity. The token’s stability complements the potential benefit from the Fed’s new proposal.

Insights from the Coincu research team anticipate further interest from fintech companies and blockchain firms in seeking access to lite master accounts. This could catalyze more robust interactions between crypto-assets and traditional financial systems, fostering technological synergy. The historical precedents suggest a gradual easing toward such regulatory adjustments is expected to favor diversified financial participation.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |