- Flow blockchain rollback sparks controversy, lacks coordination with key partners.

- Potential economic losses may surpass original attack damage.

- Calls grow for halting transactions and establishing a compensation plan.

Alex Smirnov from deBridge criticized Flow’s blockchain rollback on December 28th, citing lack of coordination, potential economic losses, and systemic issues for ecosystem partners.

The rollback affects FLOW token prices, introduces risks to honest participants, and raises concerns among validators about transparency and protocol integrity.

Flow Blockchain Faces Controversy Amid Rollback Decision

Alex Smirnov, co-founder of deBridge, noted on a social media platform that the Flow team initiated the rollback without adequate communication. The lack of coordination poses a significant risk to the network’s partners and stakeholders. As the rollback progresses, reactions from the cryptocurrency community amplify doubts over the decision’s economic implications.

Smirnov suggested that the financial fallout from this rollback might eclipse the original exploit’s damage. He called for Flow validators to halt activities on the rollback chain until essential steps, such as a compensation plan, are implemented. Industry observers voice concerns over systemic issues affecting custodians, users, and businesses operating during the compromised period.

“The economic losses from a hasty rollback could far exceed the impact of the original attack, and the rollback will introduce systemic issues affecting bridges, custodians, users, and counterparties who acted honestly during the affected window.” — Alex Smirnov, Co-founder of deBridge

In response, the Flow Foundation’s engineering teams are collaborating with network partners and considering asset freezes. Smirnov’s statements have sparked a debate within the crypto community, with many professionals advocating for protocol adjustments and increased security measures moving forward.

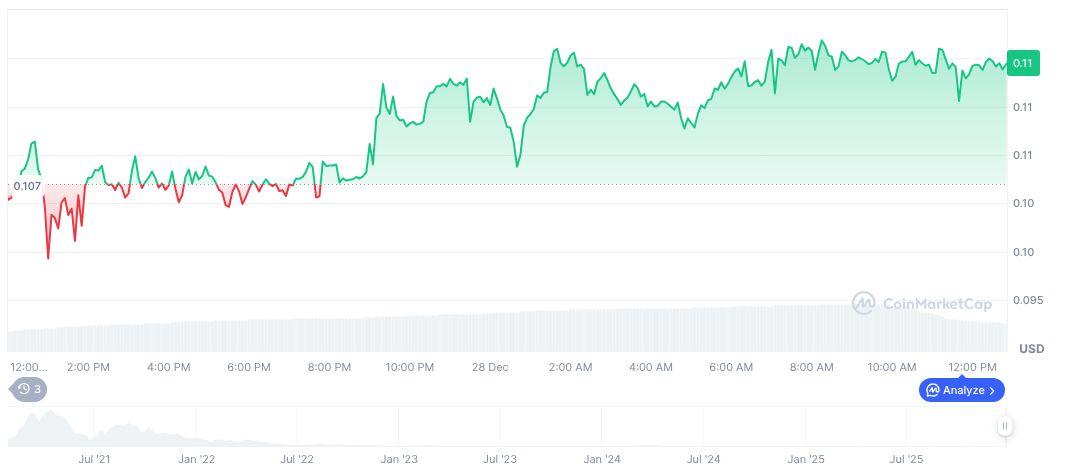

FLOW Token Price Drops Over 40% Amid Controversy

Did you know? The recent rollback action led to a >40% price drop in the FLOW token, highlighting the significant economic repercussions for the cryptocurrency market involved.

Flow’s current market position remains tense as it navigates the aftermath of this incident. According to CoinMarketCap, the FLOW token trades at $0.12 with a market cap of $193.96 million and a negligible dominance of 0.01%. Trading volume experienced a 26.30% increase within the last 24 hours. Notably, FLOW witnessed a downturn across various timeframes: 31.54% over a week, 49.83% over a month, 56.43% over 60 days, and 65.78% over 90 days as of the last update.

Analysts from the Coincu research team note the potential need for regulatory oversight and improved security architecture in blockchain protocols following this controversy. By strengthening system resilience, similar issues could be mitigated effectively, possibly returning investor confidence in affected digital assets.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |