- Flow protocol’s updates, financial impact, network status changes, expert insights.

- Flow network is in read-only mode.

- $3.9M in assets moved off-network.

Flow, developed by Dapper Labs, faced an execution-layer exploit resulting in a $3.9 million outflow through cross-chain bridges, leading to a network halt and subsequent recovery efforts.

The incident highlights vulnerabilities in blockchain infrastructure, affecting user trust and market stability, as Flow coordinates with partners to secure the network and resume normal operations.

$3.9 Million Exploit and Network’s Halted Operations

Flow encountered a security breach where $3.9 million was transferred off-network via cross-chain bridges. According to Flow’s official update, “Validators have deployed the protocol fix and restored the network to a checkpoint prior to the attack. The network is online and generating blocks, but remains in an idle / read-only mode while regular transaction submission is paused.”

The current suspension of normal transactions results from the need to ensure system alignment. The Flow team continues to work on a full operational recovery, indicating that user balances remain secure, though manual transaction resubmission will be required once the network resumes.

The blockchain community awaits a final network status update, emphasizing the importance of restoring trust in security protocols. Major exchanges and partners have received requests for cooperation, and the incident highlights critical considerations for cross-chain security.

Market Reaction and Future Security Measures

Did you know? In 2025, Flow faced one of its biggest breaches at $3.9 million, paralleling key exploits from early 2020 in terms of financial impact and recovery challenges.

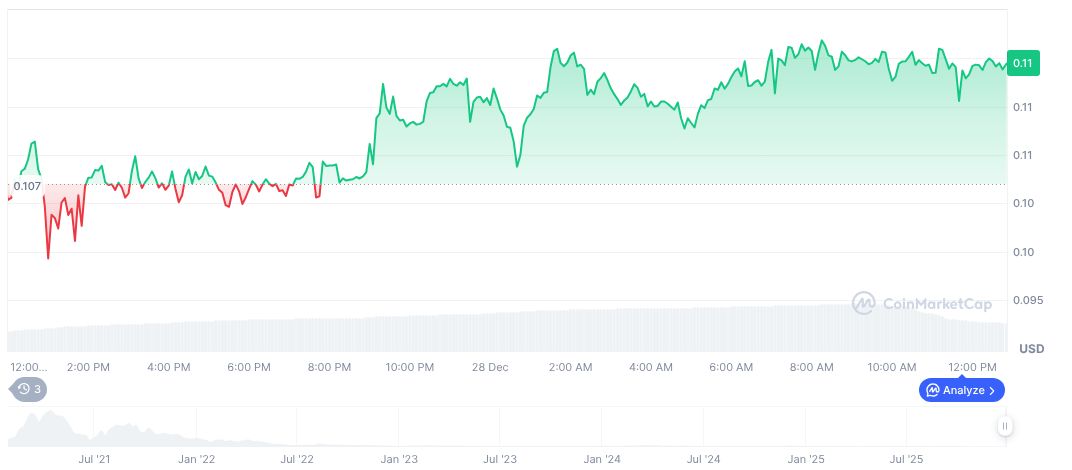

Flow (FLOW) is currently valued at $0.11, maintaining a market cap of $179.08 million. Despite a significant 1.42% rise in the last 24 hours, reflecting slight recovery post-incident, the coin suffers from a historical 53.22% drop over 30 days, as noted by CoinMarketCap.

According to the Coincu research team, the incident has the potential for far-reaching market effects. Increased vigilance concerning security practices and cross-chain asset movement is anticipated as exchanges and users seek stable conditions. The event underscores the need for enhanced collaborative oversight mechanisms.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |