Franklin Templeton’s XRP ETF Launches, Surpasses 63 Million Assets

- Franklin Templeton’s spot XRP ETF launches on NYSE Arca, managed by Coinbase Custody.

- Achieves holdings near 63 million XRP within a week.

- Market cap reaches $127.84 million, net asset value grows to $125.63 million.

Franklin Templeton’s XRP spot ETF holdings surged to nearly 63 million XRP within a week of trading, as reported by PANews on December 6.

This significant growth indicates strong investor interest and potentially positions the ETF as a key player in the cryptocurrency market.

Franklin Templeton’s XRP ETF Hits $127.84 Million

Franklin Templeton has successfully launched its spot XRP ETF on NYSE Arca, marking significant progress in regulated cryptocurrency offerings. Supported by Coinbase Custody, the ETF has swiftly gathered a substantial 63 million XRP holdings in just one week.

With the ETF reaching nearly $127.84 million in market value and a net asset value of $125.63 million, interest in spot XRP exposure shows potential for further institutional investments. The number of outstanding shares has grown to 5.7 million, signaling strong demand.

Significant market attention follows this ETF launch, with investors keenly observing potential impacts. Major industry figures have yet to issue formal statements, but the fund’s rapid growth suggests positive sentiment towards Franklin Templeton’s strategy in crypto investments.

XRP Price and Regulatory Impact Analyzed

Did you know? The launch of Franklin Templeton’s XRP ETF marked one of the fastest accumulations of digital assets within an ETF’s initial week, showcasing strong institutional appetite for crypto-tracked financial instruments.

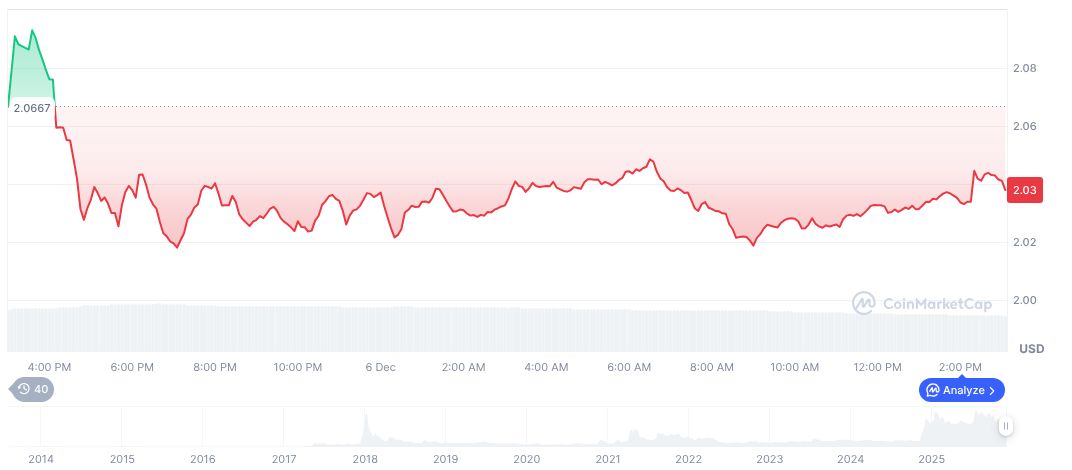

According to CoinMarketCap, XRP is currently priced at $2.04, with a market cap of $123.13 billion and dominance of 4.02%. The XRP supply stands at 60.33 billion against a maximum of 100 billion.

Coincu’s research team anticipates positive regulatory outcomes due to structured ETF frameworks, potentially enhancing XRP adoption. The ETF’s success indicates a keen market interest, though extensive regulatory adaptations remain crucial for broader cryptocurrency acceptance.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |