- IMF suggests caution in Fed rate cuts due to inflation risks.

- Potential ripple effects on cryptocurrency markets anticipated.

- No immediate market reaction noted, but monitoring is ongoing.

The International Monetary Fund stated on September 11th that the Federal Reserve can gradually lower interest rates despite U.S. inflation risks tied to tariffs.

This insight into potential Fed actions may influence digital asset markets, although no major crypto personalities have commented publicly as of now.

IMF Urges Fed to Balance Rate Cuts With Inflation

The IMF’s recent report suggests the Federal Reserve has room to reduce rates, albeit cautiously. Jerome Powell’s comments align with this cautious approach, reflecting ongoing inflation concerns.

Interest rate adjustments could weaken the US dollar, prompting investors to consider alternative value storage options such as cryptocurrencies. No immediate reactions have been observed, but speculative positioning may occur.

“We also would say that the Fed should proceed cautiously, of course in a data-dependent way, in the coming months.” — IMF, World Economic Outlook Update, July 2025

Market players and governments have yet to react officially. Notable figures like Jerome Powell are maintaining a prudent stance. The crypto community remains alert for potential policy shifts and subsequent market responses.

Crypto Markets Brace for Fed’s Monetary Decisions

Did you know? Historical data show that after similar Fed dovish pivots in 2020, Bitcoin surged significantly, highlighting its sensitivity to US interest rate changes.

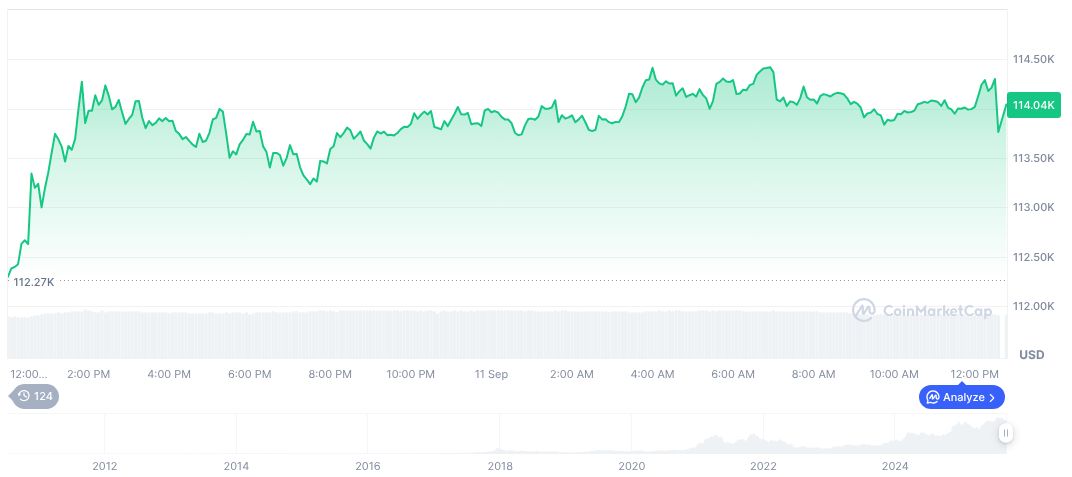

Bitcoin (BTC) is priced at $114,328.10, with a market cap of $2.28 trillion. Its market dominance stands at 57.50%, while 24-hour trading volume is $48.0 billion, down 10.19%. BTC price changed by 0.39% in 24 hours, rising 4.41% over 7 days (CoinMarketCap, September 11, 2025).

Coincu Research suggests that a potential interest rate cut may stimulate crypto investment, particularly in an environment of economic unpredictability. This scenario could favor increase risk appetite, enhancing investment flows toward decentralized finance platforms and digital assets.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |