Kain Warwick Evaluates Funding Options Amid Slow Infinex Token Sale

- Kain Warwick considers personal funding for Infinex due to low subscription rates.

- Warwick’s initial $300 million FDV target cut to appeal to retail investors.

- Infinex’s small uptake could influence future cryptocurrency funding models.

Kain Warwick, founder of Synthetix and Infinex, addressed funding concerns on X amid slow Infinex token sale, emphasizing personal financial commitment if necessary.

Warwick’s statement highlights potential challenges in crypto fundraising amid shifting valuations, reflecting broader market sentiment and community engagement dynamics in the decentralized finance sector.

Warwick’s $300 Million Valuation Target and Investor Response

Warwick commented on reduced fundraising, stating he might re-assume full funding if needed. At the INX token sale onset, expectations set by a $300 million FDV were subsequently lowered, aiming to resonate better with retail investors. Given the current $460,000 raised within nearly its first day, funding dynamics are being reassessed.

The choice to cut valuation targets reflects attempts to boost attractiveness. Investors have shown limited interest, and future financing may rely heavily on internal or alternative funding channels if the sale stagnates. Warwick’s assurance of assuming financial responsibility highlights a commitment to project continuity.

Community responses note potential risks in light of the funding shortfall. With revised allocations and caps in play, stakeholders express mixed sentiments. Warwick’s proactive funding stance amidst changing market appetites demonstrates leadership resilience during financial uncertainty.

CoinMarketCap Data Shows INX Token’s Volatility and Potential

Did you know? Kain Warwick previously self-funded Synthetix’s first 18 months, establishing a precedent for successfully navigating early financial hurdles. His approach with Infinex could mimic similar self-reliant strategies to bridge gaps.

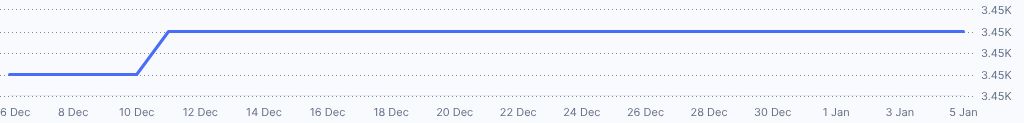

According to CoinMarketCap data, the INX token is currently at zero dollar trading, with no market cap or circulating supply. Despite this, the token has shown a significant rise over a 90-day period, increasing by 156.53%. Such changes indicate volatility but also potential in the long-term management of the token.

CoinCu researchers suggest that financial strategies and regulatory shifts could determine market future impact. With trends showing drastic supply changes, experts aligned with Warwick’s preemptive autonomy foresee flexible methodologies driving Infinex’s success or reevaluation.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |