- Korbit fined for AML violations; leadership faces reprimands.

- Mirae Asset acquisition talks unaffected by the fine.

- No immediate changes seen in major cryptocurrency markets.

South Korea’s Financial Intelligence Unit fined cryptocurrency exchange Korbit 2.73 billion won for anti-money laundering violations identified during an October 2024 inspection.

The fine highlights increasing regulatory scrutiny on South Korean exchanges, potentially influencing future compliance practices and market perceptions amidst ongoing acquisition talks by Mirae Asset Financial Group.

South Korea Hits Korbit with $1.9 Million AML Fine

The Financial Intelligence Unit of South Korea fined Korbit for failing to comply with Anti-Money Laundering (AML) regulations. The violations included about 22,000 cases of inadequate Customer Due Diligence, unreported transactions with foreign service providers, and missing risk assessments for new assets, such as NFTs.

The fine poses a potential hurdle to Korbit’s acquisition by Mirae Asset, however, there are no confirmed changes to the ongoing acquisition discussions. Korbit remains subject to increased scrutiny as South Korea strengthens its financial regulations.

No specific quotes available from involved parties. All leadership, regulatory, and expert reactions were not identified in the current results.

Historic AML Breaches Highlight South Korea’s Tough Stance

Did you know? In November 2025, South Korea’s FIU fined Upbit for similar AML breaches, highlighting the country’s intensified regulatory measures within its cryptocurrency sector.

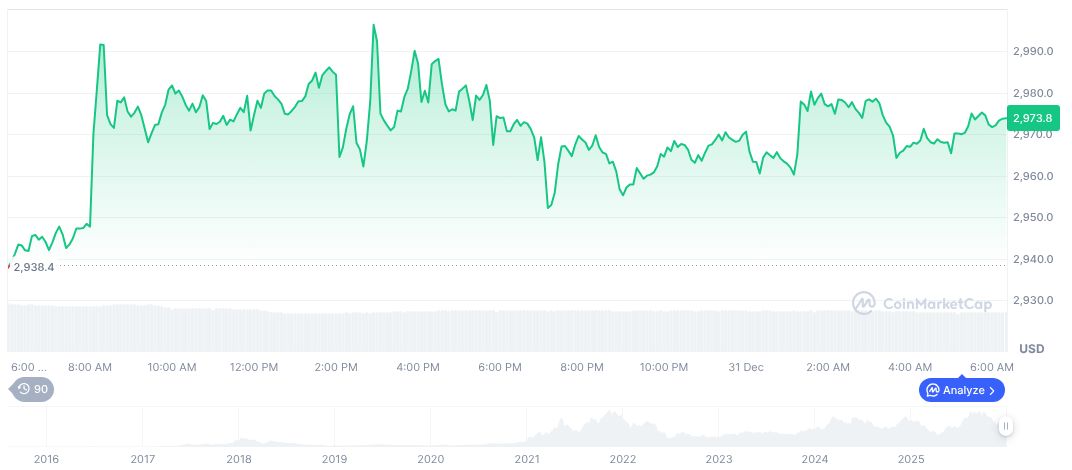

Ethereum (ETH), as of December 31, 2025, reports a price of $2,978.77, with a market cap of $359.52 billion. Despite its dominance of 12.12%, ETH’s trading volume decreased by 12.40%, hinting at market volatility. Thirty-day trends show an increase of 6.79%, data according to CoinMarketCap.

Coincu Research highlights a trend towards stricter global crypto regulations. Such penalties, they argue, could deter non-compliant exchanges and boost public trust, potentially leading to enhanced investor assurance and technological advancements in compliance systems.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |