- MicroStrategy was denied S&P 500 inclusion recently.

- This highlights institutional caution on Bitcoin-heavy firms.

- Shares dropped, impacting corporate crypto strategies.

MicroStrategy’s attempt to join the S&P 500 was denied on September 11, 2025, despite meeting all inclusion criteria, due to caution over its Bitcoin-heavy balance sheet.

This rejection signals broader institutional reluctance toward corporate crypto treasuries and impacts potential Bitcoin exposure, affecting both MicroStrategy’s stock and wider crypto market sentiments.

S&P 500 Snubs MicroStrategy over Bitcoin Ventures

MicroStrategy, rebranded as Strategy, despite meeting all technical requirements, was rejected from the S&P 500 due to concerns from the index committee about its Bitcoin-focused strategy. The decision holds broader implications for other companies accumulating Bitcoin.

Market insights reveal the effects of this rejection on Strategy’s stock, which saw a 3% drop. This reflects the skepticism about Strategy’s financial appeal in the absence of S&P 500 inclusion. The rejection denies MSTR significant ETF and index fund inflows, critical for Bitcoin exposure in financial indices.

“Why wasn’t $MSTR allowed into the S&P 500 Index despite meeting all the criteria? Because the ‘Committee’ said no. You have to realize SPX is essentially an active fund run by a secret committee. We intv’d the dude who used to run this committee on Trillions. Check it out.” — Eric Balchunas, Senior ETF Analyst, Bloomberg

Institutional Bitcoin Strategy Faces New Challenges with Market Fluctuations

Did you know? Previously, companies like MicroStrategy entering indices like Nasdaq 100 triggered significant financial movements, enhancing Bitcoin’s institutional appeal.

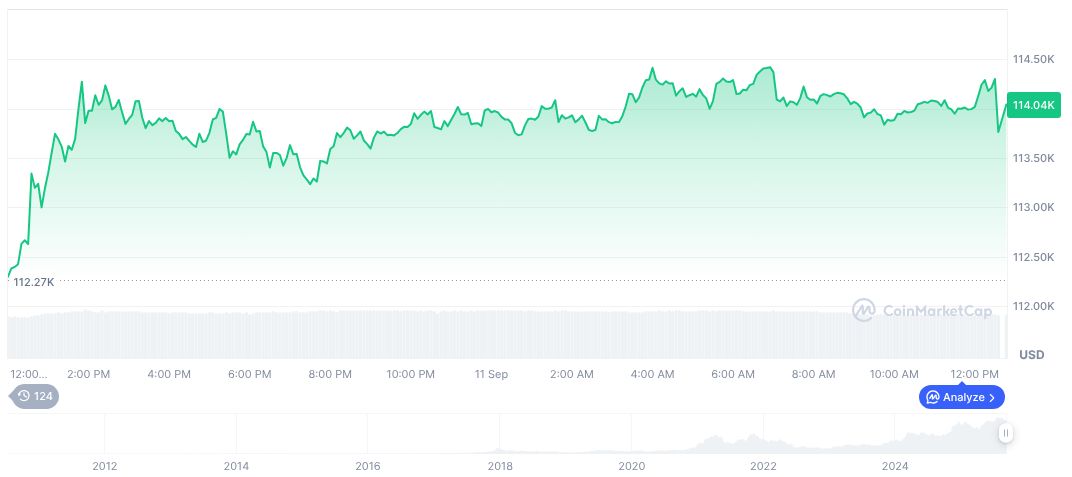

Bitcoin (BTC) is currently valued at $114,572 as of September 11, 2025, with a market cap of $2.28 trillion. It holds a 57.51% market dominance, according to CoinMarketCap. Recent data shows a 0.86% rise in the price over 24 hours, reflecting the market’s resilience amid recent developments.

Coincu’s research indicates that strategic decisions involving Bitcoin treasuries influence both financial outcomes and regulatory pressures. Market volatility might continue as institutional and retail adopters reconsider exposure routes, especially in the light of traditional index practices.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |