- Moody’s introduces stablecoin rating framework, assessing credit and market risks.

- Proposal open for comments until January 26, 2026.

- Potential impact on fiat-backed stablecoins like USDT and USDC.

Moody’s has announced a new stablecoin rating framework to assess credit and market risks, with public feedback open until January 26, 2026, potentially influencing stablecoin valuations globally.

This move could redefine stablecoin investment strategies, impacting liquidity in crypto markets and aligning with global regulatory trends on reserve quality and transparency.

Moody’s Methodology Targets Stablecoin Reserve Quality and Risks

This framework aims to differentiate stablecoins based on their underlying reserve assets, which could affect their ratings. Stablecoins backed by higher-quality reserves may receive better ratings than those backed by riskier assets. This change could influence institutional investments and market liquidity.

Major market reactions are yet to emerge, as key figures and institutions have not publicly commented on Moody’s new framework. Consequently, the full impact on market preferences for stablecoins will unfold in responses and rating announcements.

“This new methodology by Moody’s seeks to set a standard in how stablecoins are assessed, aligning them more closely with traditional financial instruments.”

Tether and USDC Under Spotlight as Framework Evolves

Did you know? Moody’s framework for stablecoin ratings echoes its long history of money market fund evaluations, potentially reshaping how digital assets are viewed by institutional investors.

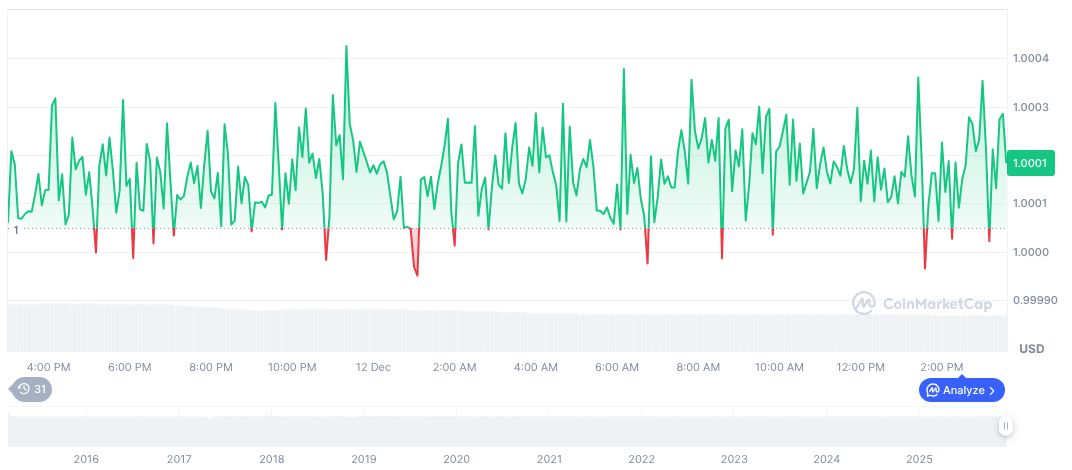

According to CoinMarketCap, Tether USDt (USDT) retains a stable price of $1.00 with a market cap of $186.23 billion and a 24-hour trading volume of $79.96 billion, reflecting a slight 13.02% decrease in daily activity. USDT’s price has changed -0.01% over 24 hours, 7 days, and 0.02% over 30 days, underscoring its stability.

Research from the Coincu team suggests that Moody’s framework may prompt regulatory bodies to refine guidelines for reserve transparency. This could lead to greater scrutiny of stablecoins, potentially urging issuers to strengthen their reserve asset pools and operational infrastructure.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |