- Moody’s unveils stablecoin credit rating methodology highlighting asset quality and risks.

- Reserve quality directly influences ratings.

- Market reactions remain observant; potential regulatory influence evident.

Moody’s has introduced a new framework to rate stablecoin creditworthiness, potentially assigning different ratings even to those with identical 1:1 USD backing, reported on December 13.

This framework could reshape stablecoin market dynamics, influencing institutional usage and competitive positioning among USD-pegged tokens.

Moody’s Framework to Reshape Stablecoin Assessments

Moody’s Ratings has released a framework to assess stablecoin credit risk, reported by its corporate site. This development evaluates stablecoin reserve assets and operational risks to assign ratings. Moody’s aims to refine the assessment of stablecoin creditworthiness with a rigorous methodology focused on the redemption obligations.

Market value risks and asset maturity serve as critical components in deriving ratings. Moody’s envisages a system where two stablecoins can differ in ratings despite similar 1:1 USD backing because of distinct reserve asset facets, thus potential volatility and risk dispersion.

“Two stablecoins both claiming ‘1:1 USD backing’ can receive different ratings because their reserve asset composition, maturities, custody structure, and operational risk differ, leading to different risk of shortfall under stress.” — Moody’s methodology document, Moody’s Corporate Site

Reactions have been cautious, with institutional clients primarily focusing on how ratings might influence cryptocurrency collateral frameworks. Community discussions, although informal, speculate about a potential impact on stablecoin issuers like Tether and Circle.

Tether’s Stability Amid Framework Introduction

Did you know? Moody’s stablecoin framework parallels their AAA-rated methodologies for money-market funds, aiming for institutional trust through regulated asset quality evaluation.

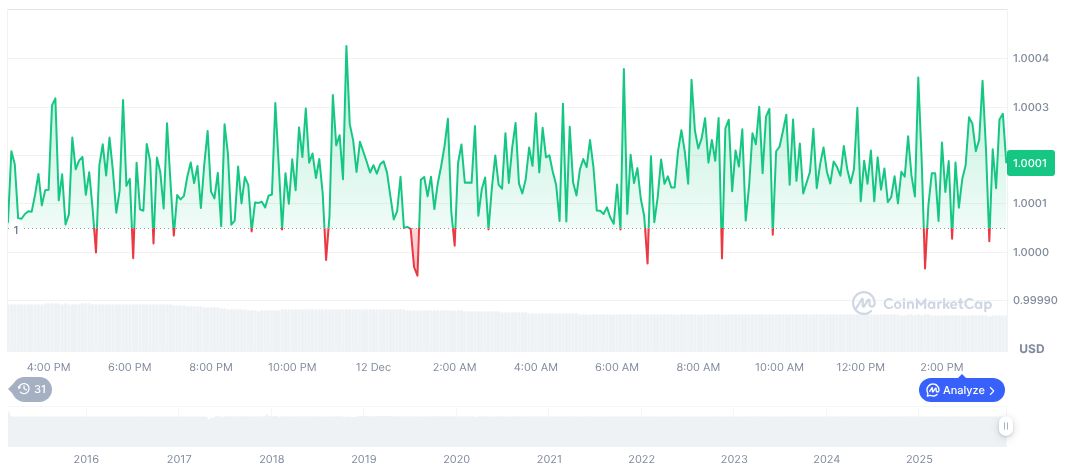

As of December 13, 2025, CoinMarketCap lists Tether USDt at $1.00, with a market cap of $186.23 billion and 24-hour trading volume at $76.82 billion, showing a -13.60% decrease. Recent price changes indicate relative stability, with variations over 90 days showing a -0.04% differential.

The Coincu research team anticipates Moody’s framework could align stablecoin evaluations with traditional finance standards. Institutional adoption may pivot towards highly-rated stablecoins, potentially reshaping liquidity landscapes with shifts in collateral preferences.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |