OCC Conditionally Approves Trust Charters for Five Crypto Firms

- OCC conditionally approves trust charters for five crypto firms, including Circle.

- Firms must meet specific conditions within a set timeframe.

- Approval facilitates integration of crypto and traditional finance.

The Office of the Comptroller of the Currency (OCC) granted conditional approval for five trust bank charters, including Circle, to advance digital asset management as of December 13.

This approval marks a pivotal step towards integrating cryptocurrency with traditional finance, allowing companies to manage digital assets and process payments, enhancing financial infrastructure significantly.

OCC’s Crypto Charter Move: Circle and More Approved

The OCC’s decision to conditionally approve trust bank charters for Circle, BitGo, Digital Assets, Paxos, and Ripple, marks a significant step for these entities. It followed the OCC’s detailed review of each firm’s application, including factors such as capital adequacy and risk management.

The conditional approval allows these companies to act as trustees managing client assets, but they must meet specific conditions within a defined timeframe to achieve a full national trust bank charter. Integration into traditional finance is one potential outcome.

Community reactions have shown optimism, with Circle’s potential to provide USDC fiduciary management receiving particular attention. Stock market impact was noted in Circle Internet Group, Inc.’s (NYSE: CRCL) affirmation of this milestone in strengthening USDC infrastructure. “Conditional approval marks key milestone toward GENIUS Act compliance and strengthens USDC infrastructure,” said Circle Internet Group, Inc., NYSE: CRCL.

Historical Roots and Market Analysis of OCC’s Decision

Did you know? The OCC’s conditional charter approval mirrors past trust company efforts and furthers crypto-financial integration, recalling its 2003 stance on chartering trust operations to foster similar advancements.

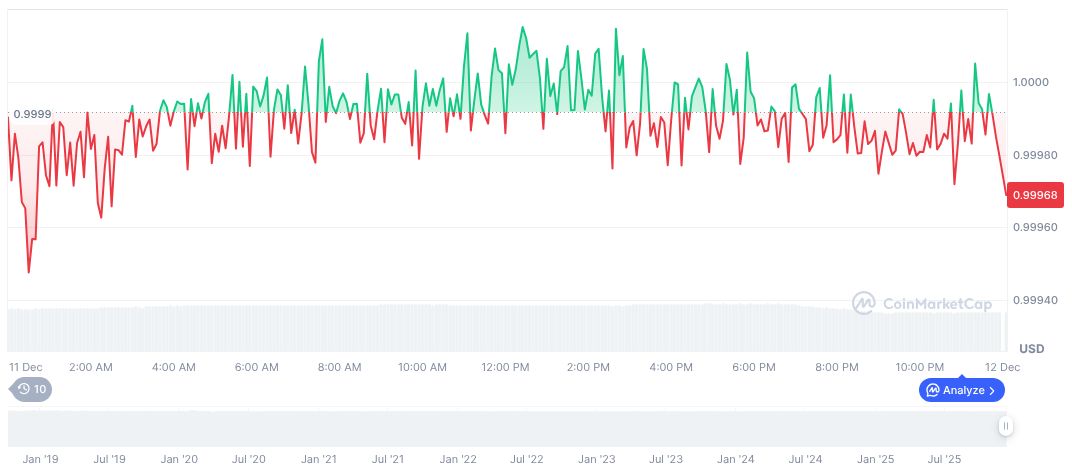

The stablecoin USDC, priced at $1.00, holds a market cap of $78.49 billion and a market dominance of 2.57% according to CoinMarketCap. Its 24-hour trading volume dropped by 21.11%, reflecting ongoing market fluctuations.

Insights from the Coincu research team suggest that trust bank charters signify regulatory acceptance and could spur further financial services innovation. Historical context indicates a cautious but progressively embracing regulatory stance, bolstering confidence in crypto’s banking potential.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |