- X downranks crypto posts after bot traffic surge.

- A 1,224% rise in crypto-themed posts caused algorithm changes.

- X’s algorithm adjustments affect market and community communication.

CryptoQuant CEO Ki Young Ju reported a 1,224% surge in crypto-related posts on Platform X causing algorithmic throttling, affecting legitimate crypto content visibility on January 11th.

This incident underscores the challenge of balancing anti-spam measures and genuine content distribution, impacting traders and analysts who depend on real-time crypto discussions on social platforms.

Platform X Bot Surge Leads to Crypto Post Downranking

Platform X’s temporary adjustment to its algorithm was initiated after CryptoQuant’s CEO highlighted a marked increase in bot-driven posts. This surge led to downranking of cryptocurrency content to curb spam. However, the move inadvertently hit genuine users too.

The shift in content visibility has caused concern among the crypto community, impacting engagement for analysts and users needing real-time updates. Market participants are evaluating how this affects information flow and trading activities in the crypto landscape.

Community backlash has been notable, with several users reporting reduced reach of crypto-related posts. Ki Young Ju openly criticized the lack of nuance in X’s approach, emphasizing the importance of exploring other spam-control measures to protect legitimate conversations.

A bot on X posted 7,754,367 crypto-related posts yesterday, a 1,224% increase, which led X’s algorithm to block or throttle posts containing ‘cryptocurrency/crypto’.– Ki Young Ju, Founder & CEO, CryptoQuant [5]

Historical Challenges in Balancing Spam and Real Discourse

Did you know? During prior crypto-related social platform interference, key industry players reported similar issues, impacting content reach unintentionally, illustrating repeated challenges in balancing spam control and legitimate discourse visibility.

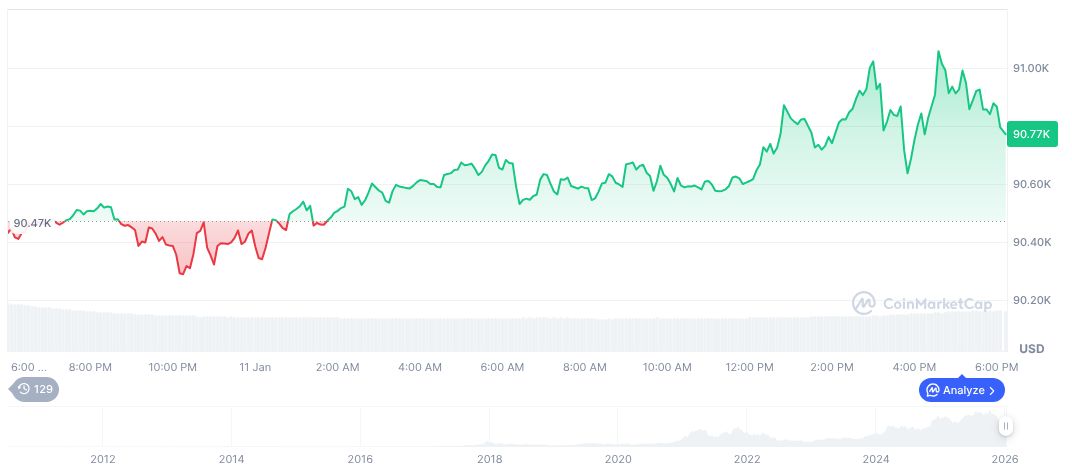

Bitcoin (BTC), as of January 11, 2026, stands at a price of $90,416.33, with a market cap of $1,806,031,392,804. Over the past 90 days, BTC’s price has dropped by 21.86%, as reported by CoinMarketCap, reflecting broader market volatility.

Coincu’s research team points out potential disruptions in community engagement that might lead to evolving strategies in crypto communication. Historical patterns indicate similar platform content challenges, prompting the exploration of decentralized communication networks to mitigate similar risks in the future.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |