- Poland’s crypto bill resubmitted for EU MiCA compliance; vetoed previously.

- No changes made to the resubmitted bill.

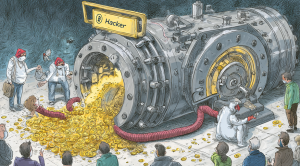

- Focus on national security concerns related to Russia.

The Polish government has reintroduced the ‘Crypto-Asset Markets Law’ on December 13, aiming to align with the EU’s regulatory standards, after a previous veto by President Nawrocki.

This move seeks to address security concerns tied to Russia and the former Soviet republics, potentially impacting licensing and oversight of crypto-asset service providers in Poland.

Poland Sticks to Original Bill for EU Compliance

The Crypto-Asset Markets Law was submitted without any adjustments. The original proposal was vetoed by President Karol Nawrocki due to incomplete information on security risks. With no textual changes, the bill seeks to establish EU-compatible regulatory standards.

Immediate implications include enforced licensing and oversight. The Polish Financial Supervision Authority (KNF) will oversee compliance, impacting service providers and introducing requirements like stablecoin reserves.

Rafał Leśkiewicz, Journalist, noted that the “Government approved bill to align with EU’s Markets in Crypto-Assets (MiCA) regulation, designating Financial Supervision Authority (KNF) for oversight.”

Market Insights with Ethereum’s Price Fluctuations

Did you know? Poland’s decision to resubmit the crypto bill aligns with previous EU regulatory compliance efforts, underscoring ongoing regional security challenges.

Ethereum (ETH) is priced at $3,085, with a market cap of $372.34 billion, according to CoinMarketCap. The 24-hour trading volume decreased by 14.71% to $23.26 billion. ETH’s price fell by 4.56% in 24 hours, with longer-term declines noted over 60 and 90 days.

According to the Coincu research team, regulatory alignment likely affects the financial landscape, strengthening market oversight. Historical trends suggest enhanced investor protection and compliance efforts across the region.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |