- Polygon’s Madhugiri upgrade boosts TPS by 40%, increasing industry competitiveness.

- Targeting 5,000 TPS in six months.

- Community anticipates further adoption and usage.

Sandeep Nailwal, co-founder and CEO of the Polygon Foundation, announced on X that the Madhugiri hard fork increased Polygon’s TPS by 40%, now achieving 1,400 TPS.

This upgrade positions Polygon to potentially lead the global payments market, with ambitious targets of reaching 100,000 TPS within 24 months, impacting its ecosystem scalability.

Polygon’s 40% TPS Boost Targets 5,000 in Six Months

Sandeep Nailwal confirmed the successful implementation of the Madhugiri hard fork, increasing Polygon’s TPS by approximately 40% to 1,400. The enhancement aims for further scalability goals, including 5,000 TPS in the next six months, and 100,000 TPS within 12 to 24 months.

This increase in transaction processing capacity is intended to reduce congestion and costs on the network. The focus is on making Polygon a preferred chain for global payments, significantly enhancing its throughput capacity.

Historical Insights and MATIC’s Market Position

Did you know? The Polygon network, previously known as Matic Network, was initially launched in 2017, positioning itself as a key Ethereum scaling solution from its inception.

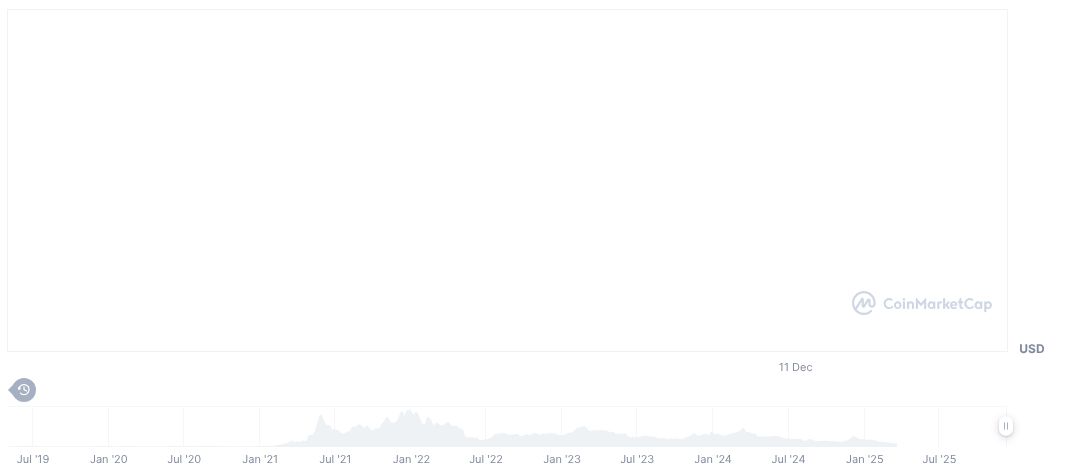

Based on CoinMarketCap data, MATIC currently trades at $0 and shows varied price movements over timeframes, including a 26.70% decline over the past month. Polygon’s fully diluted market cap stands at $2.18 billion, reflecting its significant industry position.

The Coincu research team suggests that increased TPS will likely improve Polygon’s adoption and usage, further aligning with ongoing technological improvements. The strategic roadmap, focused on scaling innovation, promises enhanced network performance and increased market presence in the coming years.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |