- Stephen Milan advances in nomination process, potentially affecting monetary policy.

- Confirmation vote set for next Monday in full Senate.

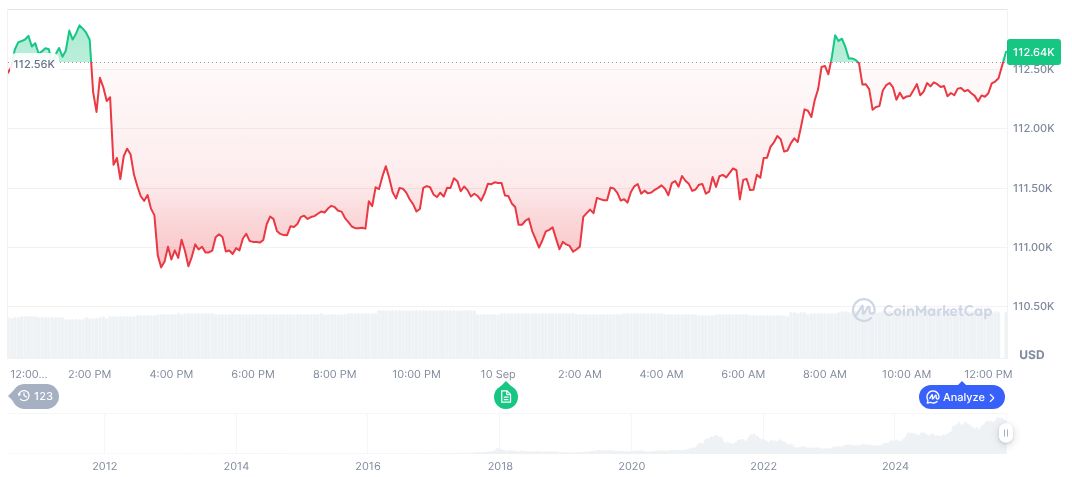

- Possible shifts in Fed policy could impact cryptocurrencies like BTC and ETH.

The U.S. Senate Banking Committee has approved Stephen Milan’s nomination to the Federal Reserve Board with a 13-11 vote, setting the stage for full Senate confirmation next Monday.

Milan’s confirmation could influence upcoming Federal Reserve policies, particularly the anticipated rate cut, impacting cryptocurrency markets including Bitcoin and Ethereum.

Senate Committee Pushes Milan’s Fed Nomination Forward

The U.S. Senate Banking Committee has advanced Stephen Milan’s nomination to the Federal Reserve Board with a 13-11 vote along partisan lines. This decision moves Milan closer to official confirmation by the Senate, a key element in President Trump’s efforts to influence the Fed’s future direction.

Whether Milan can be confirmed in time before the Federal Reserve’s interest rate meeting … will be very challenging. Launching a new process will also take a lot of time.

Lawmakers and industry leaders are closely watching the process. Republican Senator Cynthia Lummis highlighted ongoing challenges in ensuring a timely confirmation before important Federal Reserve meetings. Market participants are also speculating on the potential impacts of Trump’s majority influence on the Fed.

Milan’s Potential Influence on Cryptocurrency Market Dynamics

Did you know? Similar Federal Reserve appointments during President Trump’s term, including those of Judy Shelton, have historically sparked market speculation, though actual policy shifts, such as rate cuts, led to significant movements in both traditional and crypto markets.

According to CoinMarketCap, Bitcoin (BTC) currently stands at $114,088.30 with a market cap of approximately $2.27 trillion and a market dominance of 57.47%. Recent price movements indicate a 2.26% increase over the past 24 hours, while the broader 30-day and 90-day changes show -5.00% and 6.04%, respectively. These figures reflect ongoing market volatility and the potential impact of broader economic factors.

Insights from the Coincu research team suggest that Milan’s confirmation could influence regulatory attitudes towards digital assets. Historical data shows that Federal Reserve actions can lead to increased crypto-market volatility as investors adjust their strategies to new macroeconomic signals.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |