- SoloTex receives FINRA approval for blockchain stock trading.

- Platform aims to eliminate barriers between traditional finance and blockchain.

- Commitment to compliant issuance and real share ownership mechanisms.

SoloTex, a collaboration between Texture Capital and Sologenic, has achieved FINRA approval to offer tokenized stock ownership for U.S. retail investors, announced on October 15th.

This initiative bridges traditional equities with blockchain, possibly transforming asset ownership and regulatory compliance in the U.S. financial market.

Key Developments, Impact, and Reactions

By tokenizing U.S. equities, SoloTex looks to eliminate barriers between traditional finance and blockchain solutions, emphasizing transparent trading and ownership. According to Richard Johnson, CEO of Texture Capital, “SoloTex aims to distinguish itself from competitors by offering real share ownership with the tokens.” This statement underscores the platform’s commitment to ensuring that tokens are issued only with the underlying stock purchased, as he explained further:

Responses from key figures in the industry remain limited, with no notable comments from major cryptocurrency personalities noted. However, Mike McCluskey, CEO of Sologenic, championed the approval as “unlocking a new chapter for asset ownership.”

“SoloTex aims to distinguish itself from competitors by offering real share ownership with the tokens. The platform issues the tokens only when the underlying stock is purchased and holds real shares in regulated custody under U.S. legal frameworks…”

Historical Context, Price Data, and Expert Analysis

Did you know? Tokenized stocks offered by offshore platforms previously lacked shareholder rights and were often unavailable to U.S. users. SoloTex’s approach is a legal first for retail markets.

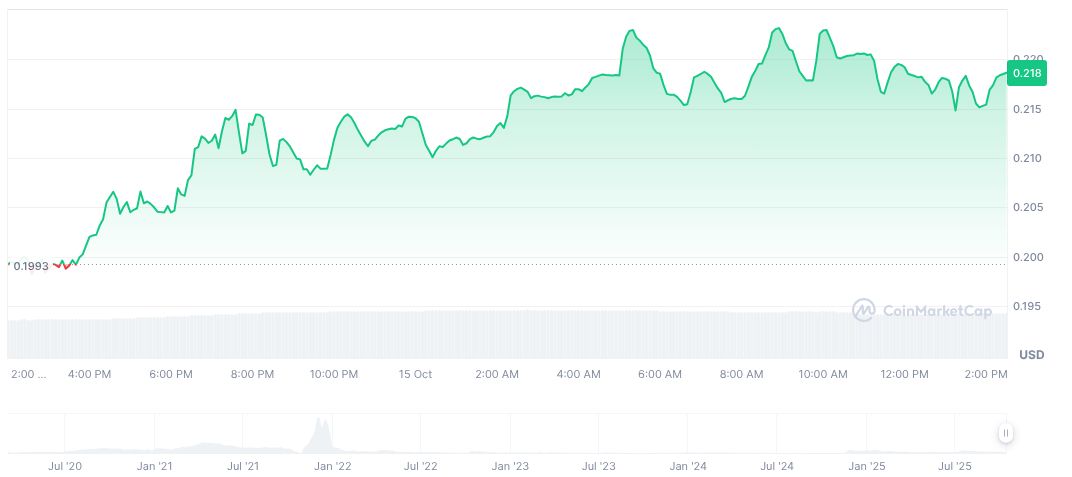

Sologenic (SOLO) currently trades at $0.22, reflecting a recent 9.36% increase in 24-hour trading, according to CoinMarketCap. The market cap stands at $87.18 million with a fully diluted value of $87.45 million, amidst fluctuating prices over the past months.

The Coincu research team highlights the potential impact of SoloTex’s initiative on mainstream acceptance and regulation of blockchain-based financial instruments. Historical data suggests that similar efforts have occasionally faced regulatory hurdles, but SoloTex’s compliance-first approach could lead to smoother integration into market structures.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |