Square Launches Bitcoin Payments and Wallet for Small Businesses

In Brief

- Square unveils Square Bitcoin, integrating payments and wallet tools for U.S. sellers.

- Merchants can now accept bitcoin with zero fees and convert sales into BTC holdings.

- Global Bitcoin fund assets top $200B as Deutsche Bank predicts central bank adoption.

Square has introduced Square Bitcoin, a fully integrated Bitcoin payment and wallet solution designed for small and medium-sized businesses. The platform combines Bitcoin Payments and Bitcoin Conversions, enabling sellers to accept Bitcoin transactions with zero processing fees and manage assets directly within the Square ecosystem.

The launch marks a major expansion of Square’s financial tools, aligning with the company’s goal of simplifying bitcoin adoption for everyday commerce. Through this new integration, sellers can accept bitcoin payments at the point of sale and automatically convert a portion of their daily revenue into bitcoin holdings.

Bitcoin Payments allows merchants to process transactions instantly with low fees, helping them retain more profits and access new customer segments. Meanwhile, Bitcoin Conversions enables automatic diversification, allowing up to 50% of daily card sales to be converted into Bitcoin seamlessly.

The company said early adopters of the feature have accumulated over 142 BTC as of October 2025, showing growing institutional participation. Bitcoin Payments will officially launch on November 10, 2025, following the success of Bitcoin Conversions, which is already available to eligible U.S.-based sellers.

Bitcoin Market Expansion and Institutional Forecasts

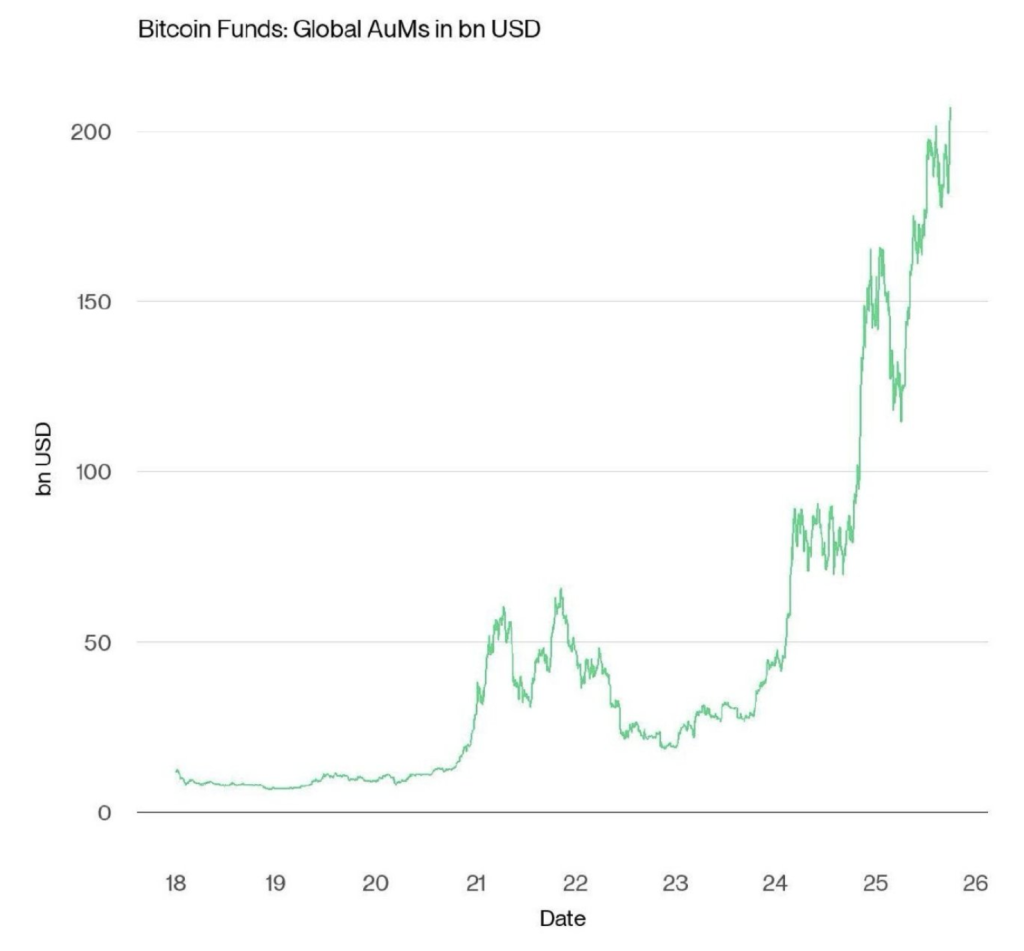

The announcement comes as global Bitcoin fund assets surpass $200 billion, highlighting accelerating institutional and retail adoption. Major financial institutions are beginning to recognise bitcoin as a long-term asset, moving beyond its speculative phase.

Moreover, Deutsche Bank, managing more than €1.6 trillion in assets, recently predicted that central banks will hold bitcoin by 2030. The forecast underscores the growing acceptance of digital currency as a legitimate financial instrument within global banking systems.

Square’s initiative builds on Block’s broader bitcoin ecosystem, including Cash App, Bitkey, and Spiral, aiming to make bitcoin an everyday financial tool. The expansion also reinforces bitcoin’s transition from a speculative investment to an integrated component of modern financial infrastructure.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |