Global Remittance Market Faces Transformation with Stablecoins’ Rise

- Stablecoins adoption reshapes global remittance, affects Western Union.

- GENIUS Act boosts regulatory acceptance.

- Traditional institutions face tech and compliance challenges.

On January 17th, BlockBeats News reported an accelerating shift in the $900 billion global remittance market as stablecoins promise reduced costs and time for cross-border payments.

The use of stablecoins could disrupt traditional remittance systems, such as Western Union, with lower transaction fees, affecting low-income groups sending money to developing countries.

Stablecoins Challenge Existing Providers and Spark Industry Changes

Stablecoins are set to revolutionize the remittance landscape by making cross-border transactions cheaper and faster. With the current average transaction cost over 6%, stablecoins propose a streamlined alternative. The GENIUS Act’s regulatory backing has pushed these digital assets further into mainstream awareness and practical use.

Industry giants like Western Union and PayPal now seek entry into the stablecoin arena, diversifying their remittance solutions. However, they confront the challenge of adapting existing operations to embrace blockchain-driven efficiencies while maintaining established client trust. 2026 Digital Economy Insights: Trends in Digital Assets discusses how crypto-based firms like Coinbase benefit from technological dexterity, leveraging nimble adaptation to the evolving financial ecosystem.

“Innovation and regulation are not opposing forces. Clear rules give us the confidence to treat stablecoins as part of the core settlement toolkit rather than a speculative side bet. In 2026, the conversation shifts from ‘if’ to ‘how’ we integrate regulated digital liquidity into global payments.” – Chloé Mayenobe, Deputy CEO, Thunes

Stablecoins’ Regulatory Impact and Future Adjustments in Finance

Did you know? Stablecoins have a pivotal role in reducing cross-border remittance costs potentially beneath 6%, offering a transformative edge over traditional systems like Western Union. This has historical significance in reducing financial burdens for low-income senders.

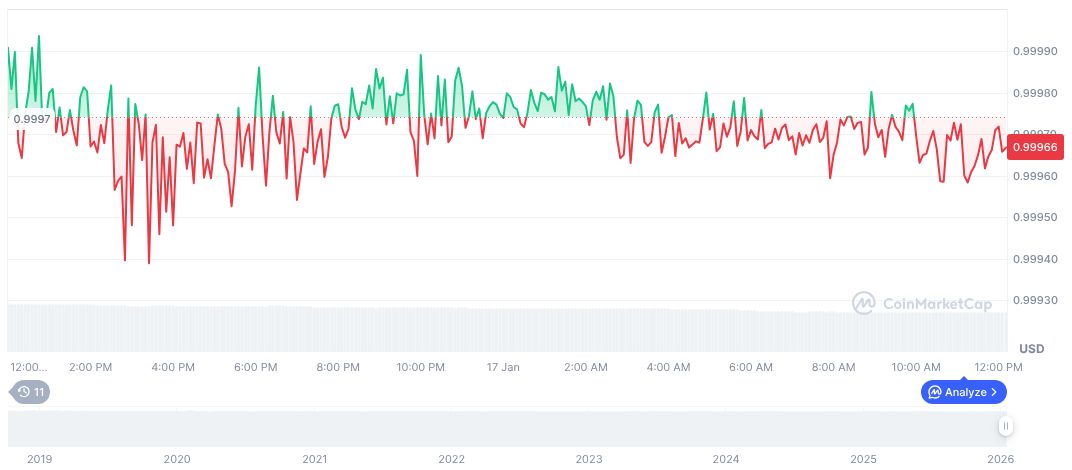

CoinMarketCap data records USDC, a fiat-backed stablecoin, at $1.00 with a stable market cap of $75.97 billion and dominant presence at 2.35% market share. Elliptic’s 2026: Global Regulatory Focus on Innovation covers how the recent trading reflects a 17.21% volume dip within 24 hours. Price steadiness observed over 7 to 90 days also underscores market demand for reliable digital liquidity.

Research indicates that stablecoins provide notable advantages in settlement speed and efficiency once integrated into banking systems. As financial landscapes ensure alignment with regulatory expectations, stablecoin deployment within the remittance sector is anticipated to grow. The GENIUS Act’s influence sets global precedence, potentially encouraging global regulatory harmonization and streamlined digital asset adoption.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |