- Startale collaborates with SBI Holdings to introduce yen-pegged stablecoin by Q2 2026.

- Stablecoin aims for institutional and global use.

- SBI focuses on compliance; Startale on technology.

Japanese firms Startale Group and SBI Holdings announced plans to launch a fully regulated, yen-pegged stablecoin by Q2 2026, aimed at facilitating global settlements.

The plan could enhance international transactions and mark a significant step for digital currencies in Japan’s heavily regulated financial ecosystem.

Startale and SBI’s Strategic Stablecoin Initiative

Startale Group, a prominent blockchain infrastructure company, and SBI Holdings, a major financial entity, are collaborating to introduce a fully regulated yen-pegged stablecoin by 2026. The stablecoin will be used for institutional and global transactions.

Shinsei Trust & Banking will oversee the stablecoin’s issuance and redemption, while SBI’s VC Trade will manage circulation. Startale is set to handle the technology development, focusing on enhancing the stablecoin infrastructure.

“The whole financial market is moving from an offchain environment to onchain. We believe that the tokenized stock revolution is the largest opportunity and onchain trading is the next frontier… This isn’t just about digitizing existing assets, it’s about creating entirely new financial primitives that merge the trust of traditional equities with the composability and accessibility of DeFi.” — Sota Watanabe

Japan’s Regulatory Landscape and Market Implications

Did you know? Japan’s regulatory framework offers strong support for stablecoin operations, reflecting a strategic step forward since SBI’s partnership with Ripple in 2016.

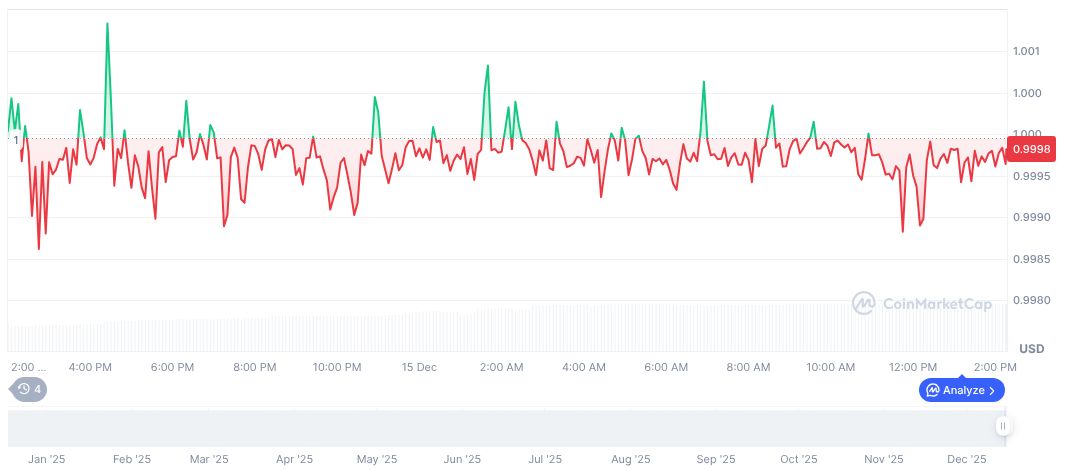

Ripple USD (RLUSD) remains at $1.00, a stable choice in the volatile market. With a market cap of $1.03 billion, it shows a 1.67% increase over 24 hours. Recent data from CoinMarketCap reveals a mixed trend with minor dips over 60 and 90 days.

The Coincu research team highlights this yen-pegged stablecoin as a strategic step towards broadening Japan’s influence in the global stablecoin arena. It aligns with ongoing shifts towards integrating digital currencies within mainstream financial systems.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |