- Telegram’s Russian bonds frozen due to Western sanctions.

- Plans impacted but debt repayments remain on schedule.

- No confirmed shift in financial markets or trading volumes.

Telegram’s $500 million Russian bonds were reportedly frozen due to Western sanctions, affecting debt buyback efforts and raising concerns among investors, while revenue rose by 65%.

The freeze could potentially disrupt Telegram’s financial strategies, as it integrates Toncoin and eyes an IPO, amid investor worries about its financial health and strategic direction.

Telegram’s $500M Bonds Freeze Amid Sanctions Pressure

The freeze of Telegram’s $500 million Russian bonds has placed notable pressure on the company’s financial strategies. Despite these challenges, Telegram asserts its intentions to repay debts on time. This development is rooted in Western sanctions targeting Russian financial entities, affecting a vast range of investments.

Investor sentiment has been impacted as some express concern regarding Telegram’s fiscal health. Nonetheless, Telegram’s revenue reports a 65% increase, totaling $870 million year-over-year. Operational pressures persist as the company navigates a $222 million net loss, largely attributed to the devaluation of Toncoin.

Pavel Durov, founder and CEO of Telegram, has not commented on the bond freeze or its implications, focusing instead on privacy advocacy since establishing Telegram in 2013 after leaving VK. He has lived outside Russia since 2014.

Rising Revenue and IPO Preparations Amid Economic Challenges

Did you know? EU sanctions have previously frozen approximately €170-210 billion in Russian assets, funneling around €8 billion of interest to Ukraine over recent years.

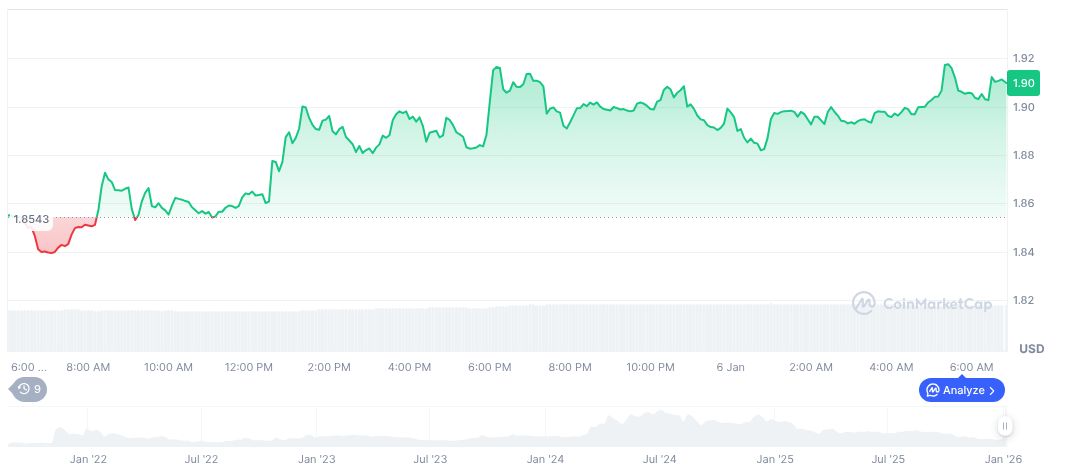

Toncoin currently trades at $1.91 with a market capitalization of $4.62 billion. The cryptocurrency displays a 19.42% price increase over the past month, with a notable dip of 30.24% over the last quarter, according to CoinMarketCap.

Expert insights from the Coincu research team point to ongoing challenges with global sanctions possibly affecting the broader tech industry. While financial markets remain reactive, the long-term consequences for companies like Telegram will depend on strategic adaptations and geopolitical developments.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |