- Telegram’s 2025 IPO plans amid financial challenges and Toncoin sales.

- Revenue grew with exclusive crypto agreements, despite challenges.

- The market reacts to Telegram’s losses and assets being frozen.

Telegram reported a 65% increase in revenue to 870 million dollars in H1 2025, driven by exclusive Toncoin agreements.

The growth is overshadowed by financial challenges including significant cryptocurrency value losses and Russian bond freezes amid geopolitical tensions.

Telegram’s 2025 Revenue Projections and Financial Strain

Telegram’s expected revenue for the first half of 2025 reached an estimated $870 million, including $300 million from Toncoin-related agreements. However, the cryptocurrency’s sharp decline necessitated a write-down, creating significant financial strain for the company.

Telegram’s reported decline in Toncoin’s value and frozen bonds in Russia reflect broader market impacts. The planned IPO and the anticipated shift in financial strategies draw attention to Telegram’s navigation through regulatory landscapes and ongoing restructuring.

Noteworthy reactions include increased scrutiny from investors concerning Telegram’s fiscal health. Pavel Durov, the company’s CEO, continues advocating recovery strategies while progressing towards a proposed IPO, hinting at Telegram’s commitment to long-term shareholder value and market confidence. Pavel Durov, Founder & CEO of Telegram, noted, “We achieved profitability in 2024, recording over $1 billion in revenue.”

Toncoin Market Volatility and Telegram’s Strategic Moves

Did you know? Telegram’s projected revenue in early 2025 signifies a 65% rise, primarily from Toncoin. Yet, this asset’s 69% drop mirrored other market-wide corrections, similar to historical crypto downturns.

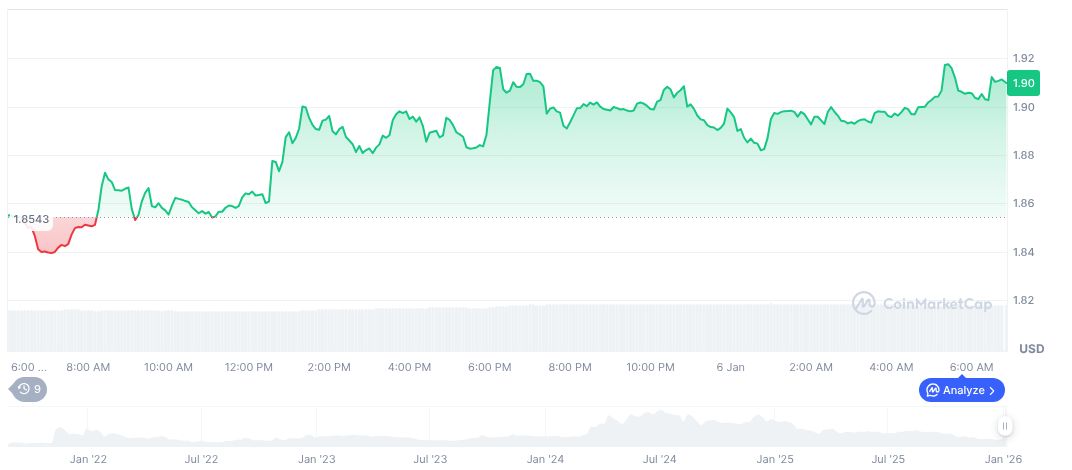

Toncoin’s current price stands at $1.94, with a market cap of approximately $4.68 billion, accounting for 0.15% of the total market. The trade volume in the past 24 hours is recorded at about $134 million, with a recent price uptick of 2.44% according to CoinMarketCap. Over the past 90 days, its value dropped by 28.81%, highlighting persisting volatility.

Analysts from Coincu suggest that Telegram’s financial adjustments, alongside bond issuance and proposed IPO plans, could lead to critical shifts in crypto regulatory environments and market stabilization efforts. Bold investments in blockchain technology continue to bridge sector-specific gaps, paving the way for dynamic market integration.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |