- Kevin Warsh is considered for Federal Reserve Chair, impacting market forecasts.

- Trump’s policy influence emphasized, affecting interest rate dynamics.

- Market forecasts shift with Warsh’s increased nomination probability.

President Trump suggested Kevin Warsh might be the next Federal Reserve Chair, challenging the institution’s independence with his support for lower interest rates, reported the Wall Street Journal.

This potential appointment could influence U.S. monetary policy significantly, altering interest rate expectations and shaping financial markets’ future direction, reflecting ongoing political influence over economic decisions.

Bitcoin Price Trends Amid Federal Reserve Changes

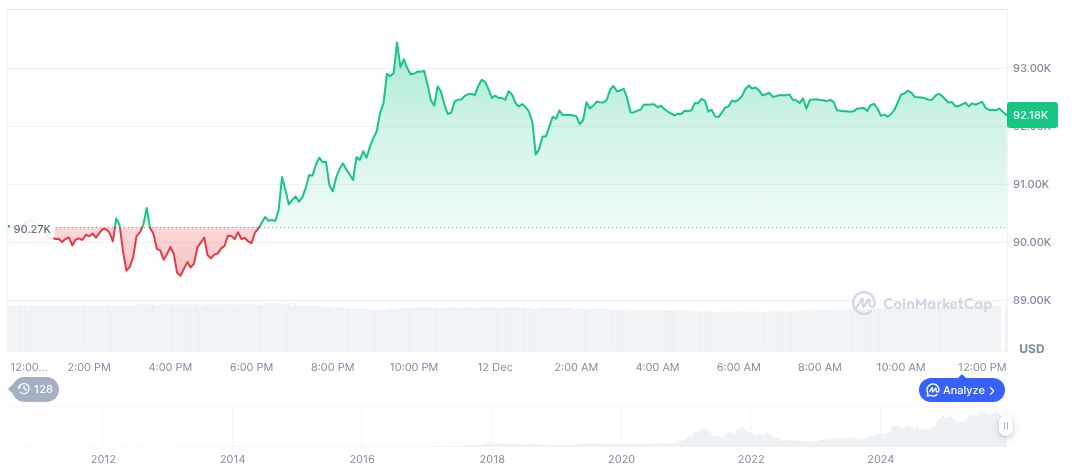

Bitcoin (BTC) currently holds at $90,422.42 with a market capitalization of $1.80 trillion as reported by CoinMarketCap. Over the past 24 hours, the trading volume reached $81.64 billion, despite a 1.96% dip. BTC’s seven-day trend has seen a modest increase of 0.84%, though it has decreased by 12.17% in the last month and 21.96% over 90 days. With a circulating supply of 19,961,596 Bitcoins and a max supply cap at 21 million, market dominance stands at 58.64%.

Coincu’s research team suggests that the potential appointment of Warsh could lead to a steady dovish stance in Federal Reserve policies, translating into lower interest rates. Historical analysis highlights similar leadership shifts have resulted in volatile equity markets, though cryptocurrency markets remain unaffected directly by Fed appointments.

President Donald Trump, President of the United States, “Warsh has risen to the top of his shortlist, though Hassett and others remain in contention, and emphasized that the next Fed Chair should consult me on rates.”

Market reactions have reflected this shift in leadership preferences and potential rate changes. Kalshi’s data reveals notable adjustments in nomination probabilities, with Warsh’s rise correlating with expectations for more accommodative monetary policy. These developments underscore the significant role that the potential Federal Reserve Chair’s views on economy and monetary policy are likely to play.

Market Data and Insights

Did you know? President Trump’s ongoing criticism of Fed Chair Jerome Powell’s policies aligns with his push for a chairperson who may consult him on rates, evoking historical calls for stronger executive influence over monetary policy decisions.

Bitcoin (BTC) currently holds at $90,422.42 with a market capitalization of $1.80 trillion as reported by CoinMarketCap.

Coincu’s research team suggests that the potential appointment of Warsh could lead to a steady dovish stance in Federal Reserve policies, translating into lower interest rates.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |