- Senator Tim Scott pushes crypto bill with bank CEOs.

- Legislation targets stablecoin issues under GENIUS Act.

- Bipartisan effort highlights regulatory engagement.

Senator Tim Scott announced ongoing progress on a significant cryptocurrency bill after discussions with major bank CEOs, including Bank of America’s Brian Moynihan, at meetings held on December 12.

The proposed legislation seeks to regulate the digital asset industry, addressing stablecoin market distortions and enhancing SEC and CFTC powers, which could reshape crypto market dynamics.

Senator Scott Leads Dialogue with CEOs on Crypto Regulation

In recent efforts to enhance regulation within the cryptocurrency sector, Senator Tim Scott engaged with executives from Bank of America, Citigroup, and Wells Fargo. The discussions addressed the introduction of a critical cryptocurrency bill intended to streamline market rules and enhance operational transparency.

The proposed legislation aims to establish comprehensive guidelines for digital assets, granting the SEC and CFTC the power to regulate the industry more effectively. The key focus revolves around curbing market-distorting incentives linked to stablecoins, addressing loopholes present in the existing GENIUS Act.

Senator Tim Scott, Chairman, Senate Banking Committee, – “The GENIUS Act has enabled a stablecoins economy-wide.”

GENIUS Act’s Role in Digital Asset Regulation Scrutinized

Did you know? The GENIUS Act, passed in 2025, marked the first federal law addressing digital assets in the U.S., setting a precedent for stablecoin regulations while drawing criticism for its limitations in addressing interest-related incentives.

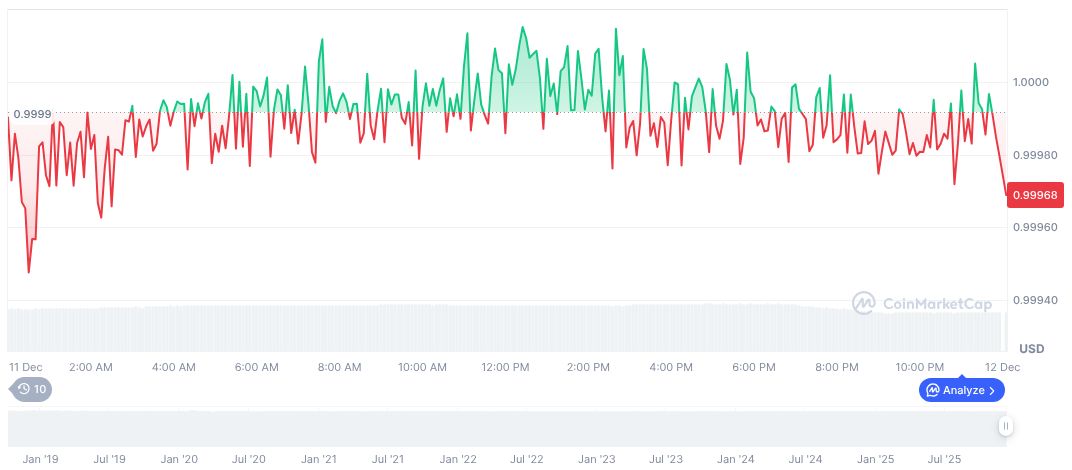

USDC maintains a stable price of $1.00, as reported by CoinMarketCap, with a market cap of $78.58 billion USD and a market dominance of 2.52%. Trading volume reached $12.68 billion USD within 24 hours, showcasing its consistent demand. The asset’s price exhibited minimal fluctuation over 24 hours, reflecting its stability.

The Coincu research team highlights the potential for evolving regulatory landscapes, with a focus on balanced frameworks that address both innovation and security. Ongoing discussions stress the importance of international cooperation to mitigate risks associated with digital finance.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |