- U.S. and Singapore discuss stablecoin adoption, engaging key global leaders.

- U.S. Treasury and Singapore emphasize regulatory frameworks and digital asset future.

- Potential market impacts on USDT and USDC not immediately evident yet.

U.S. Treasury Secretary Scott Bessent and Singapore Prime Minister Lawrence Wong discussed stablecoin adoption in a key meeting on October 31, 2025, underlining increasing U.S.-Asia digital asset engagement.

This meeting highlights a significant regulatory development in stablecoin oversight, with potential implications for digital asset markets but no immediate impact on prices or trading volumes evident.

Bessent and Wong Explore Regulatory Future of Stablecoins

The dialogue between U.S. Treasury’s Scott Bessent and Singapore’s Lawrence Wong represents a strategic approach to addressing the future of stablecoins. Both sides emphasize regulatory oversight in managing these digital assets, crucial for mitigating systemic risks. The meeting highlights a shift in U.S.-Asia digital policy engagement focus on stablecoins.

Market reactions are muted as of now, given the meeting’s regulatory discussion nature. Key figures like Bessent and Wong have not issued detailed public statements. The market’s focus remains on significant regulatory developments, without immediate impact on stablecoins like USDT or USDC.

Janet L. Yellen, Treasury Secretary, U.S. Treasury, “Stablecoins that are well-designed and subject to appropriate oversight have the potential to support beneficial payments options. But the absence of appropriate oversight presents risks to users and the broader system…” – U.S. Treasury Press Release

Stablecoin Market Unchanged Amid Regulatory Discussions

Did you know? The United States and Singapore have engaged in discussions on digital asset regulations in past instances, peaking market interest without immediate effects on major stablecoins like USDC and USDT.

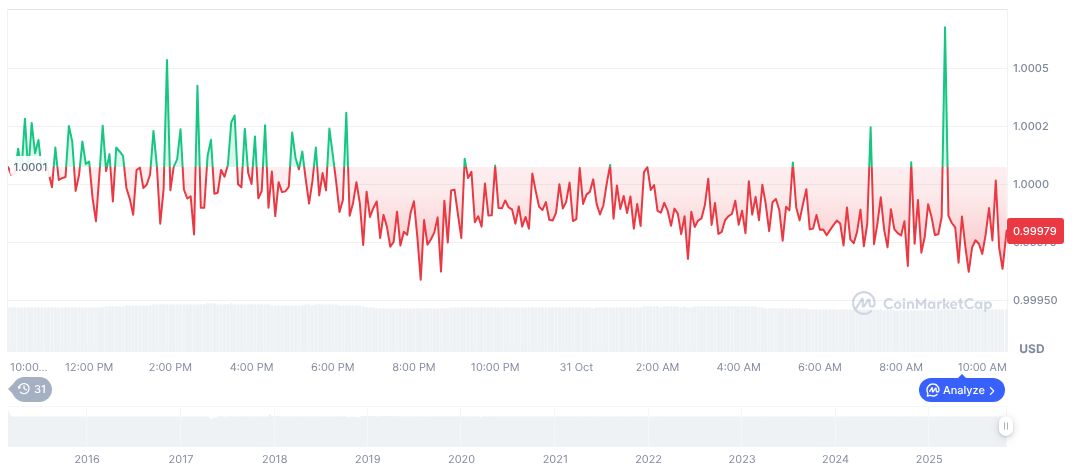

According to CoinMarketCap, Tether USDt [USDT] holds a steady price of $1.00, with a market cap of formatNumber(183307152909, 2), reflecting a market dominance of 4.96%. Despite a 24-hour trading volume of formatNumber(140900283826, 2), the 24-hour price change remains minimal at -0.08%.

Insights from the Coincu research team highlight the possible outcomes of increased regulatory focus on financial stability and digital technologies’ long-term integration. Emphasis on stablecoin security could pave the way for more secure and widely accepted digital transactions globally.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |