- Chen Zhi and multiple entities sanctioned over financial crimes.

- Southeast Asian networks’ ties with U.S. financial systems severed.

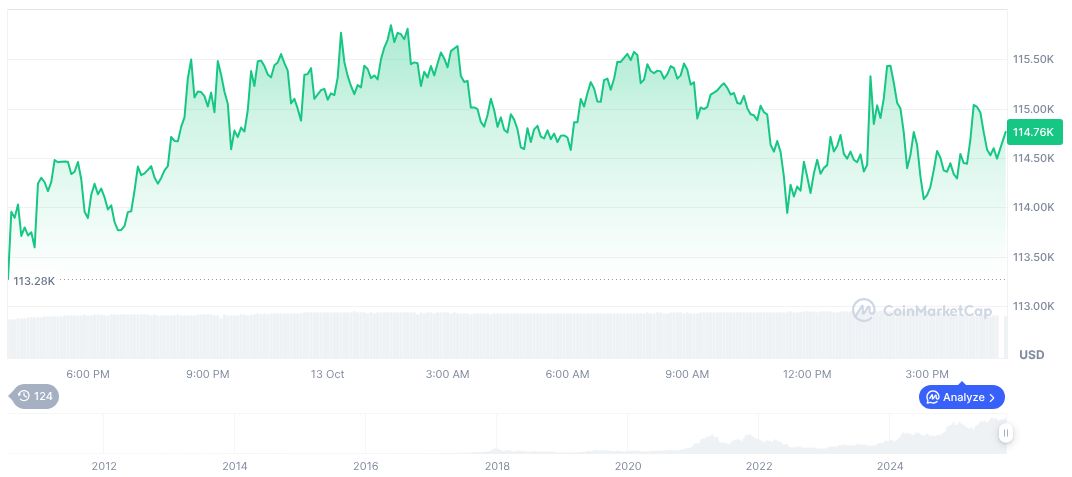

- Bitcoin’s price shows volatility amid regulatory actions.

The U.S. Treasury Department, with the UK FCDO, launched its largest action against a Southeast Asian cyber fraud ring, sanctioning Chen Zhi and cutting off Huione Group’s U.S. financial access.

This action underscores increasing global scrutiny on cryptocurrency-related crime, impacting market dynamics and regulatory landscapes as authorities clamp down on illicit financial activities.

U.S. and UK Impose Sanctions on Southeast Asian Fraud Networks

The U.S. Treasury’s Office of Foreign Assets Control (OFAC), in collaboration with FinCEN and the U.K. Foreign, Commonwealth, and Development Office (FCDO), implemented unprecedented sanctions against Southeast Asian networks. Chen Zhi, at the helm of Cambodia’s Prince Group, along with associates and affiliated shell companies, has been spotlighted for transnational criminal engagements. The allegations focus on extensive schemes involving cyber fraud, human trafficking, and laundering operations. Entities such as Prince Holding Group and Huione Group have found themselves alienated from U.S. financial interactions.

Cutting ties with Huione Group through Section 311 of the USA Patriot Act has disrupted their dealings. Their operations, alleged to have facilitated laundering activities valued around “4 billion,” are now under scrutiny. Beyond this, involvement in North Korean-related virtual currencies, coupled with scams tallying near “73 million,” is addressed. The consequences mean indispensable exclusion from dollar-clearing networks and correspondent banking systems, thereby crippling financial avenues.

“The U.S. Treasury has frozen all U.S. assets of Prince Holding Group…” – U.S. Department of the Treasury

Bitcoin’s Price Reacts to Heightened Global Regulatory Action

Did you know? Earlier actions against groups like Funnull and L.Y.P. echo these sanctions, underscoring recurring engagements in large-scale trafficking and cyber fraudulent cases across global networks.

According to CoinMarketCap, Bitcoin (BTC) is priced at $111,663.53, showing a 24-hour decline of 2.09%. With a market cap of “2.23 trillion” and dominance at 58.64%, recent volatility underscores heightened trading volumes, valued at “80.80 billion” over the same period. Insights from the Coincu research team reflect on how Bitcoin’s price trajectory, influenced by central transactions exploring illicit channels, might reshape regulator focus. Future outcomes might prompt enhanced technological oversight and stricter financial surveillance mechanisms, reinforcing preventative measures against similar occurrences.

Public statements from key players remain unavailable. However, responses from pertinent authorities underscore the action’s significance. OFAC’s assertion focuses on reaffirming global financial integrity. Remarkably, industry observers await substantial aftershocks across regional economies, fueled by the comprehensive sanctions these decisions entail.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |