- Circle issues 250 million USDC; potential market liquidity effects.

- Increased liquidity could drive DeFi growth.

- No significant reaction from influencers or regulators noted.

USDC Treasury has minted 250 million USDC on Solana at 8:40 AM on May 29, 2025, according to monitoring by Whale Alert and ChainCatcher. The minting aims to enhance liquidity across USDC-supported blockchain systems.

The issuance of 250 million USDC by Circle, detailed by Whale Alert, signals a strategy to meet rising liquidity needs in digital finance. The action might reflect growing institutional interest and demand for stable USDC-backed assets in the blockchain ecosystem.

Circle’s 250 Million USDC Mint Boosts Solana Liquidity

ChainCatcher and Whale Alert identified earlier today that the USDC Treasury minted 250 million USDC on Solana. Circle, the parent company responsible for USDC, executed this minting to address the current stablecoin demand. The event’s transparency highlights blockchain’s real-time data capabilities.

More USDC in circulation amplifies existing market liquidity. This additional supply can buoy DeFi applications and transactions, providing enhanced opportunities for decentralized finance participants and platforms within the Solana blockchain framework. The move might attract new investments.

While broader industry stakeholders are aware of these minting activities, no comments have emerged from influential figures such as Circle CEO Jeremy Allaire. The cryptocurrency community generally monitors such events closely for market trends and potential regulatory implications.

“The minting of an additional 250 million USDC by the USDC Treasury marks a significant increase in market liquidity, reflecting institutional demand and the crucial role of stablecoins in modern financial systems.” — Jeremy Allaire, CEO, Circle

USDC’s Strategic Position Amidst Global Regulatory Scrutiny

Did you know? Similar large-scale USDC issuances on Solana have previously correlated with increased DeFi protocol activity, suggesting a pattern where new liquidity injection often supports network expansion.

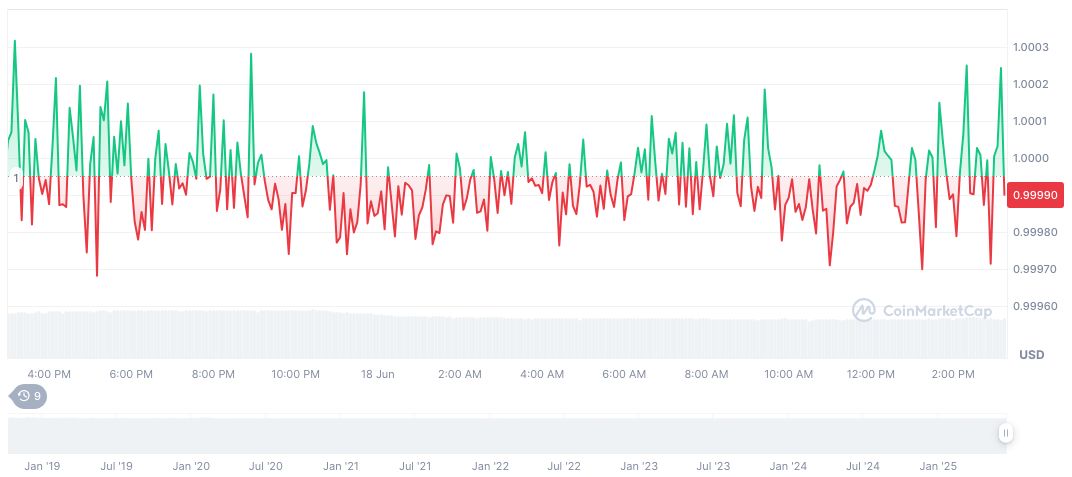

According to CoinMarketCap, USDC holds a market cap of $61.50 billion with a price of $1.00. Its market dominance is at 1.91% with a 24-hour trading volume of $9.89 billion, despite a trading downturn of 22.91%. Supply remains confidently in circulation at 61.51 billion USDC.

Coincu research suggests this issuance may strengthen USDC’s position amid tightening global regulations on stablecoins. With regulatory bodies, like the U.S. Senate focusing on transparency and backing of stable assets, Circle’s mint continues to align with potential future compliance expectations.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |