- Vanguard adds Bitcoin ETFs amidst leadership skepticism.

- Bitcoin ETF trading now available for clients.

- Skepticism persists despite market shifts.

At Bloomberg’s ETFs in Depth conference, John Ameriks of Vanguard likened Bitcoin to a “digital Labubu,” underscoring continued skepticism despite Vanguard’s new crypto-related ETF trading options.

Vanguard’s cautious approach contrasts with peers, reflecting hesitation in wholesale endorsement of digital assets amidst rising client interest in Bitcoin ETFs.

Vanguard Embraces Bitcoin Trading with a Cautious Stance

Vanguard’s decision to allow Bitcoin ETF trading comes amid skepticism from its leadership, notably from John Ameriks, who described Bitcoin as speculative. This move aligns with growing client demand while maintaining a conservative outlook.

The change enables Vanguard’s clients to trade spot Bitcoin ETFs without company endorsements. This reflects competitive pressures, offering a choice to investors keen on cryptocurrency exposure.

Community reactions are diverse, with traditional market analysts maintaining skepticism about Bitcoin’s value proposition. Vanguard’s stance is contrasted by firms like BlackRock supporting Bitcoin ETFs, sparking industry discussions.

Bitcoin Market Dynamics and Expert Forecasts Discussed

Did you know? Bitcoin’s acceptance by major asset management firms like Vanguard represents a turning point in cryptocurrency’s integration into traditional finance, despite ongoing skepticism.

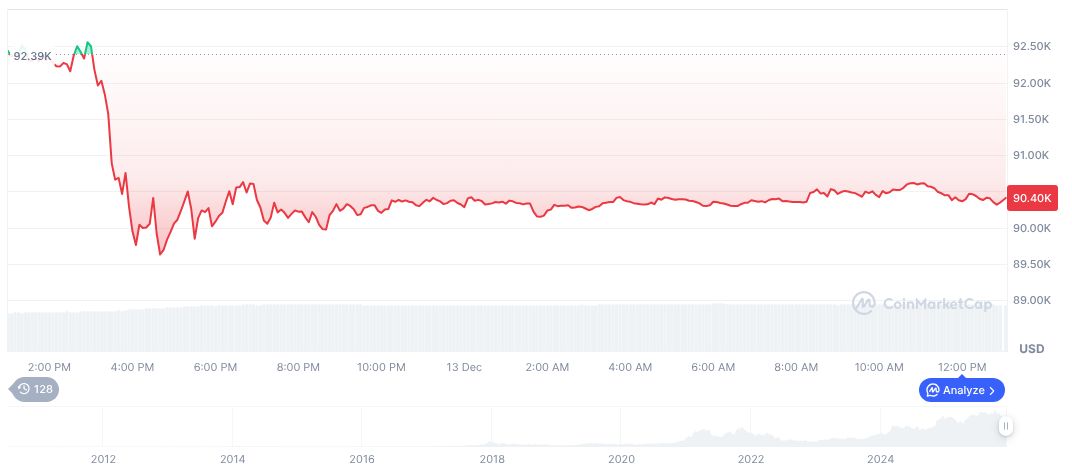

According to CoinMarketCap, Bitcoin is trading at $90,112.82, with a market cap of $1.80 trillion. Trade volume decreased by 21.69% in 24 hours, and the price dropped by 0.13% over the same period. Bitcoin’s 90-day decline is 22.22%, reflecting recent volatility.

Coincu research suggests that financial markets could experience further regulatory scrutiny as asset managers like Vanguard integrate crypto products. The move signals potential shifts in traditional finance perspectives on digital currencies, amid fluctuating market responses.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |